ABPAY (22)

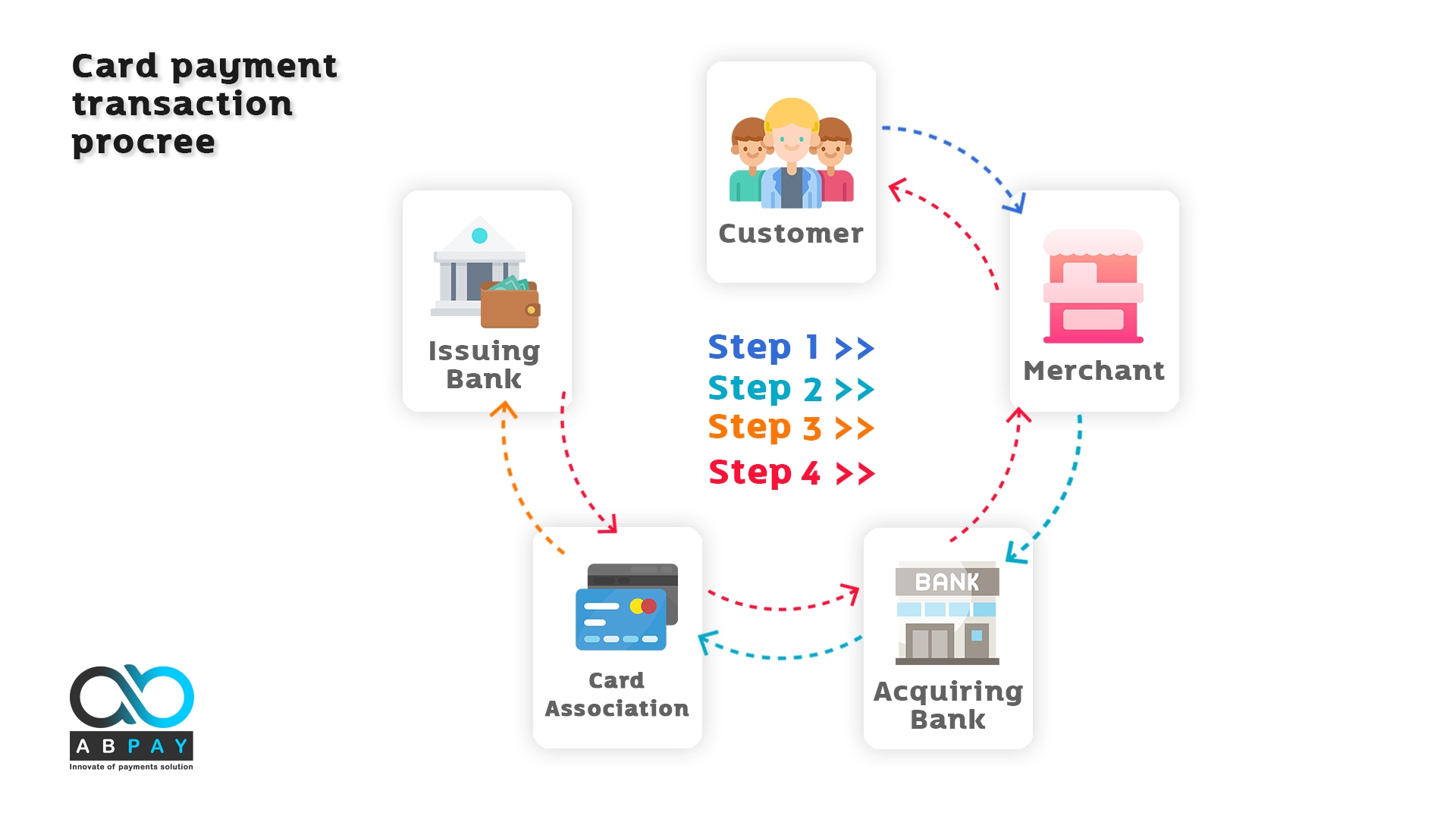

Smart solutions for quick& hassle-free integrationABPAY Merchant Solutions provide a comprehensive array of options built around our proprietary technology & platform to allow merchants to integrate with us and benefit from our wide range of payment solutions.This gives merchants flexibility, as s quick, easy and hassle free integration and allows us to get merchants up and running in a matter of days. There are 4 different ways to integrate to ABPAY Merchant Solutions:

|

|

APIAn application programming interface (API) is a set of routines, protocols, and tools for building software applications. The API specifies how software components should interact and are used when programming user interfaces. The ABPay Merchant Solutions API allows merchants to fully integrate the payment process into their own application. Card details are entered in their application or website and submitted to ABPay Merchant Solutions over a secure connection. The technology independent nature of JSon allows merchants to access ABPay Merchant Solutions services through their system regardless of the technology, language or device used. Hosted Payment Page / Pay By LinkThe Hosted Payment Page solution allows merchants to redirect customers from their checkout environment to secure myabpay.com hosted page when they arrive at the payment phase. Customers then enter their payment details which are captured by ABPay Merchant Solutions' secure servers. When payment is complete the customer is re-directed back to the merchant site.

|

|

Virtual Terminal or Online Payment TerminalThis option requires no setup by the merchant. Its used for Mobile Order/ Telephone Order (MOTO) transactions, In this scenario, ABPay provides the ‘merchant with access to our back office portal and the ability to submit transactions via a payments page. Getting on Board with ABPay Merchant SolutionsThere are two distinct workstreams to consider when getting on board with ABPAY Merchant Solutions from a commercial onboarding and technical integration standpoint. Developer DocumentationMerchant developers working on integrating deen find technical |

|

A&B GENERAL STANDARD MERCHANT

ACQUIRING TERMS

VERSION 1.0 – JAN 2020

A&B GENERAL

MERCHANT SERVICES TERMS AND CONDITIONS

These terms and conditions of business apply to the Services provided by us to you. When you sign up to use our Services, you will be asked to complete the documents in the Application Pack which will be governed by these Terms.

Please note the following important information

These Terms are legal terms which legally bind you. As such, please make sure that you have read and understood them before completing our Application Form. The Terms also set out certain limitations as well as guidance on how you are to properly use our Services. We note in particular the following clauses which you should carefully consider before agreeing to use our Services: 2 (Using our Services), 3 (Your MyAB Account and your safe use of our Services), 4 (Processing your Payment Transactions and Settlement), 5 (Service Fees and other amounts payable by you), 7 (Data Security and Privacy), 10 (Compensation), 11 (Indemnity) and 12 (Warranties and important disclaimers). We also explain the meaning of words and phrases we have given a specific meaning to either in the text below or in clause 20 (Defined terms explained). If you are unsure of any term or have any questions, please feel free to ask us.

1 OUR SERVICES

1.1 Service description. We will provide you with the Services with respect to Payment Transactions related to the sale of goods and services between you and your Customers:

a) under the agreed Card and Payment Schemes and associated payment methods;

b) for the specific Transaction Types;

c) in the permitted Settlement Currencies; and

d) in the agreed Territories,

as each of the above matters are identified and agreed in the Application Form.

1.2 Our Service standards. We will provide our Services to you in accordance with the terms of the Agreement, in compliance with Laws, Card and Payment Scheme Rules and with reasonable care and skill.

1.3 Our licence to you. We grant you a limited, personal, revocable, non-exclusive, non-transferable, non-sub-licensable licence to use and access our Services (including your MyAB Account, and any applicable Data) solely for the purposes, and in accordance with the terms set out in the Agreement. We warrant that we have the full power and authority to grant the licence provided in this clause 1.3.

1.4 Excluded Transactions. Please be aware that our Service’s support of any type of Payment Transaction is subject to the acceptance and conditions of an applicable Card and Payment Scheme (and such acceptance may be withdrawn at any time by the relevant Card and Payment Scheme). We have no influence over the Card and Payment Scheme’s acceptance policies or Card and Payment Scheme Rules. Further, we are under no obligation to provide our Services with respect to any Payment Transaction which is, or we reasonably suspect to be an “Excluded Transaction”.

Excluded Transactions are Payment Transactions which:

a) are not related to the sale of goods and services which we have agreed with you including Payment Transactions which fall within the scope of our Restricted Transactions List (as amended from time to time); and/or

b) would result in either you or us being in breach of any Laws and/or Card and Payment Scheme Rules.

Even though we have no obligation to execute Excluded Transactions that you may submit to us, we may do so at our sole discretion, and you will be liable to us for any Service Fees or other amounts which you may owe us related to the execution of those Excluded Transactions.

1.5 Other Service functionality and additional Services. We may, from time to time, offer other service functionality or services. This may include: service information, help content, bug fixes, maintenance releases, modifications, amendments and/or upgrades to the existing Services. These additional services and functionality are subject to the terms of the Agreement and/or other terms and conditions made known to you when we make the other service and/or functionality available.

2 USING OUR SERVICES

2.1 Your use of our Services. The Services are deemed accepted by you upon the earlier of (i) your execution of the Pricing Schedule; and (ii) your usage of any or all of our Services. You agree at all times to comply with the terms of the Agreement, perform your obligations under the Agreement at your own expense and in a competent and business-like manner and with reasonable skill and care.

2.2 The importance of the information you provide us. We agree to provide you with our Services with respect to the information you supply us as part of the application process, including the description of products and services that you sell and any address, premises or websites or online applications you use to trade. Our registration of you as a Merchant to use our Services is expressly and strictly dependent upon this information and descriptions, together with your warranty that you will only use our Services in the course of your own business, trade or professions and not as a consumer.

2.3 Please keep us updated on any changes to the information you have supplied us. We reserve the right to accept or reject any Merchant based on the information they provide us (whether as part of the application process or otherwise). If any information you provide to us (including information related to your business model and/or the goods or services you sell) changes over time, you must notify us immediately so that the information you have supplied to us is always accurate, up to date, truthful and complete. In particular, you must not use our Services for any other good and/or service that you have not agreed with us, nor trade from any other premises or websites/online applications without seeking our prior written approval. Any approval we may provide related to the sale of goods and/or services you trade in no way constitutes any advice nor opinion by us as to the legality or otherwise compliance with Laws of your trade in such goods and/or services.

2.4 Information requests

a) Information related to your use of our Services. You agree to provide us with any or all information reasonably requested by us related to your use of our Services and to also assist us in resolving any financial or reconciliation query we may have. This may include our or a Card and Payment Scheme’s request for evidence of a Payment Transaction and /or a Customer’s authority to debit their Payment Instrument and/or Payment Account (as the case may be) for the amount of the Payment Transaction.

Information we must collect and verify to comply with Laws. In our Application Form we will ask you to provide us with certain information about you and your business’ identity. This information will be used by us to comply with anti-money laundering laws. During the term of the Agreement, you also agree to provide us with any or all additional information which we may reasonably require, at any time, to comply with our legal and regulatory obligations.

- Your consent to us checking and verifying your information via third parties. You consent and grant us permission to make any enquiries with any third party we consider necessary to verify any information provided to us, whether to allow you to register and/or continue to use our Services or otherwise. This may include our obtaining, checking and/or reviewing applicable credit reports and/or commercial registers or databases.

- Information related to your business. You agree to provide us with any information which we may reasonably require to assess your financial situation (such as financial statements, accounts, invoices etc).

2.5 Setting up and maintaining your Settlement Bank Account. You are required during the term of the Agreement (and for such period as may be reasonably necessary after the termination of the Agreement to allow for recover of any funds due) to establish and maintain in your name (or such other name as expressly approved by us in writing) your Settlement Bank Account. You agree to provide us with complete and accurate information concerning your Settlement Bank Account and if for any reason we are unable to Settle funds to your Settlement Bank Account, (or under certain circumstances, receive funds from your Settlement Bank Account to pay us amounts you owe us), you agree to open and maintain a separate Settlement Bank Account in your name (or such other name as expressly approved by us in writing) which allows us to do so. If we agree that you can open your Settlement Bank Account in a different name to your own, you agree that any remittance of funds which we make to that named Settlement Bank Account will constitute valid receipt by you of any sums which we may be liable to pay to you in accordance with the terms of the Agreement and that you will indemnify us for any losses or other liabilities which we may suffer as a result of our payment of funds into that named Settlement Bank Account.

2.6 Direct debit mandate. At our request, you agree to arrange and carry out all such acts and sign any documents which instruct and/or authorise us to direct debit from your Settlement Bank Account any amount or sums that you owe us in accordance with the terms of the Agreement. You agree to maintain any such direct debit during the term of the Agreement as well as any longer period where you may still owe us funds.

2.7 Equipment related to your use of the Services. To use our Services you must use the program which it supplied us. You may be required by us to enter into agreements with Third Party Suppliers for the supply or hire of the Equipment. You must only use program located in the countries and/or regions that we have agreed with you. You represent, warrant and undertake to comply with any and all legal terms, the Merchant Operating Procedures and Card and Payment Scheme Rules with respect to your use of the Equipment.

2.8 Your use of approved Third-Party Systems and Services. You agree to only use Third Party Systems and Services from Third Party Suppliers related to your use of our Services where we have provided our prior written approval. If you use an approved Third-Party Supplier you authorise us to obtain information from them as we require in order to carry out the Services. If applicable, you agree to pay any testing or accreditation costs incurred by us when approving any Third-Party Systems and Services and/or associated Third Party Suppliers. Following our approval of any Third-Party System and Services with any Third-Party Supplier, you must not use another supplier’s service unless they have been certified and accepted by us.

2.9 Your Merchant Systems. You agree during the term of the Agreement that you are responsible, at your own cost, for the provision of all Merchant Systems and/or other goods/services required to use the Services. At all times when you use our Services, you must ensure that:

a) your Merchant Systems are capable of properly collecting the order or other relevant Customer Data or are otherwise compatible as required to use and receive the Services. Please note that Merchant Systems that have been modified contrary to the manufacturer’s software or hardware guidelines and specifications (including disabling hardware or software controls) are not considered to be compatible Merchant Systems. Using our Services on an incompatible Merchant System is expressly prohibited; and

b) any transmission of Data is secure and your own operations restrict and make the manipulation of data entries impossible.

2.10 Compliance with Laws and Card and Payment Scheme Rules. You agree that you are solely responsible for carrying out your business operations and performing any and all sale transactions you enter into with your Customers in compliance with all Laws and Card and Payment Scheme Rules. We will provide you with a summary of key Card and Payment Scheme Rules in the Merchant Operating Procedures and certain Card and Payment Scheme Rules can be accessed via www.visaeurope.com and www.mastercard.com. To the extent that there is any inconsistency between the terms of the Agreement and the underlying Card and Payment Scheme Rules, the underlying Card and Payment Scheme Rules will prevail.

2.11 Accepting all properly presented Payment Transactions. You agree to accept all properly presented Payment Transactions. You must not refuse a Payment Transaction because you require additional details from your Customer other than what is permitted by the applicable Card and Payment Scheme Rules.

2.12 Refunds. You are authorised (where applicable under a Card and Payment Scheme Rules) to provide Refunds for Payment Transactions you accept under the terms of the Agreement. You must only execute Refunds to the Payment Instrument or Payment Account used for the original Payment Transaction, subject to any exceptions agreed with us and in compliance with Card and Payment Scheme Rules.

a) Your refunds policy. You agree to offer your Customers a legally compliant refund policy which is consistent with your business’ industry practice and which you will notify your Customers prior to them making a Payment Transaction with you.

b) Cash refunds. In executing any Refund, you will not offer a cash refund for any Payment Transaction, nor accept cash in consideration of making a Refund (unless it is permitted under applicable Laws or the applicable Card and Payment Scheme Rules).

2.13 Pre-approved Payments. If you use our Services to execute Pre-approved Payments with your Customers you agree to acquire a valid Pre-approved Payment Authority from the Customer. Your execution of Pre-approved Payments with your

Customers is at your own risk.

2.14 Prohibited Payment Transactions. You must not execute the following types of Payment Transactions:

a) Excluded Transactions;

b) Refunds, returns, reversals or other adjustments not initially processed by us;

c) Payment Transactions which you expect to receive payment in any other form than what you submit to us (for example, you will not accept a card payment transaction and submit it via our Services and also accept cash as payment); and/or

d) Payment Transactions that you know, should know or suspect are illegal or otherwise not authorised by the Customer.

2.15 You must only accept Payment Transactions for your own account. Your use of our Services is strictly restricted to executing Payment Transactions directly between you and your Customers which are related to the genuine sale of your own goods and services (as described by you and approved by us). You are strictly prohibited from facilitating payments for any item, good and/or service made available or sold by third parties. You are also prohibited from re-selling our Services, and in any way holding yourself out as our agent.

2.16 Surcharges and ‘no discrimination’. Subject to any Laws or Card and Payment Scheme Rules, you must not, and you must make it a policy not to, discriminate against the use of a Card and Payment Scheme and their associated payment methods

in any way (including for any of the goods or services you may sell). You must not require a minimum or maximum Payment Transaction amount to accept a valid Payment Instrument. Where you add any surcharge to a Payment Transaction you

agree to provide complete and transparent information related to such surcharge. You agree that we have no liability nor responsibility to any Customer where you have failed to inform the Customer of any surcharge or related matter. You

acknowledge and agree that if you are permitted to surcharge under any applicable Laws and Card and Payment Scheme

2.17 Your Floor Limit unless agreed otherwise will be zero. From time to time we may notify you of a monetary limit applicable to your Payment Transactions which we refer to as a “Floor Limit”. You will not complete a Payment Transaction which is above

the Floor Limit without first obtaining a valid Authorisation or pre-approval from us to do so. We retain sole discretion as to any approval we may provide in connection with a Floor Limit. Unless we notify you otherwise, the Floor Limit is zero.

2.18 Disclosure of your business identity to your Customers. You must clearly and prominently disclose and make available to your Customers details of your business identity in plain and intelligible language. You must ensure that your Customers are

aware that you are responsible for the submission of Payment Transactions and the supply of goods or services throughout their course of dealings with you. This includes providing a transparent and easily found notice of your business/trading name

and your contact details (as appropriate) on your business premises, websites or other remote sales channels.

2.19 You are responsible for carrying out your sales transactions with your Customers. You agree to carry out and perform any sales transaction you enter into with your Customers (including matters such as delivery of goods (whether physical or digital)

and/or the provision of services that are part of the sales transaction). You further agree to provide any and all customer support services to your Customers relating to your sale of goods or services. You must also offer your Customers customer service and complaints contact details. In performing customer service, you agree to always represent yourself and your business operations as a separate entity or operation from us. We are not responsible for any goods and/or services, offered

or sold by you.

2.20 Protecting our and the Card and Payment Schemes reputation and goodwill. You agree not to carry out any action or omit from acting in a manner which we may consider (acting reasonably) to adversely impact our goodwill, reputation and/or

branding and/or that of the Card and Payment Schemes.

3 YOUR MYAB ACCOUNT AND THE SAFE USE OF OUR SERVICES

3.1 As part of your use of our Services, you are required to open a MyAB Account with us. Your MyABAccount is an information and data account providing details of your Payment Transactions and other related information management functionality.

Your MyAB Account does not hold any funds or stored value of any kind. When you open your MyABAccount we will provide you with Security Codes in the form of a username and password which will enable you to access and use your MyAB

Account.

3.2 Appointing Authorised Logins. Our Services permit you to set up additional authorised users and Security Codes for accessing and using the Services. Setting up such a combination and enabling another person to use our Services constitutes your

authorisation of that other person to use your MyAB Account. If you create and/or permit Authorised Logins and/or Security Code combinations, you are responsible for their management and control, as well as all actions and omissions associated

with your Authorised Logins access and use of the Services. You also agree to provide us with any information we reasonably request about any Additional Login.

3.3 Your security obligations. It is your responsibility to keep your Security Codes, your Merchant System and any Equipment safe, secure and within your possession and control. You agree to continuously monitor and establish security procedures

and protocols appropriate to the size and nature of your business to comply with the provisions of this clause (and to ensure that only Authorised Logins are using your MyAB Account and Equipment).

3.4 Actions to take if you know or suspect use of the Services has been compromised. If you know or suspect that your MyAB Account, Equipment, Merchant Systems and/or Security Codes are lost, have been stolen, misappropriated, used without

authorisation or otherwise compromised, (as appropriate) you are advised to immediately change your Security Codes and contact us without delay via This email address is being protected from spambots. You need JavaScript enabled to view it.. Once we have received valid notification of any suspected or known compromise to your Security Codes we will from that time use all reasonable endeavours to stop further illegitimate access or use of those Security Codes and/or your MyABAccount (and if appropriate, any Equipment).

3.5 Actions we may take. We may restrict your access or suspend your use of our Services and associated Equipment (in whole or in part) on reasonable grounds relating to the valid use and security of the Services and Equipment and any of its security

features (including your Security Codes). We will notify you of any suspension or restriction of your use of our Services (and if applicable, where legally permitted to do so, the reasons for such actions being taken) in advance or, where we are unable to do so, after the suspension or restriction has been imposed (unless notifying you would be in contravention of any Laws or otherwise compromise reasonable security interests). We will remove the suspension and/or the restriction as soon as practicable after the reasons for the suspension and/or restriction no longer exist. yours, or any of your or their respective employees, agents, contractors, or representatives (“Taxes”). You are also responsible for collecting, withholding, reporting and remitting correct Taxes to the appropriate tax authority. We and our Affiliates are not obligated to determine whether Taxes apply to you and are not responsible for calculating, collecting, reporting or remitting on your behalf any Taxes to any tax authority arising from any Payment Transaction.

4 PROCESSING YOUR PAYMENT TRANSACTIONS AND SETTLEMENT

4.1 Obtaining Authorisation. Before we can process your Payment Transactions, you must first obtain an Authorisation as required by us and/or the Card and Payment Scheme Rules. A Payment Transaction which has obtained an ‘authorised’

status is not guaranteed, and it may be cancelled or subject to a Chargeback by the Customer in accordance with the applicable Card and Payment Scheme Rules.

4.2 Submitting Payment Records. A condition of us processing your Payment Transactions is that you supply us with the Payment Records in the form and manner set out in the Merchant Operating Procedures and in accordance with the applicable

Card and Payment Scheme Rules. You must ensure that only one Payment Transaction data set is provided to us for each Payment Transaction.

4.3 Our risk management and taking a ‘Reserve’. We may from time to time in agreement with you establish an account with a third party bank which we will use to deposit funds to secure the performance of your obligations under the Agreement.

We call this account the “Reserve Account” and the funds deposited in the Reserve Account are known as the “Reserve”. You agree to provide us and/or your applicable financial institution with the necessary authorisation and instruction to fund

the Reserve Account in the following ways:

a) by you paying us, at our request (whether agreed in the Application Form or otherwise), with a direct payment which we will deposit in the Reserve Account; and/or

b) transferring a portion of the proceeds we have received from your Payment Transactions to the Reserve Account, either until such proceeds meet a certain amount or so those payments match a certain percentage of your Payment Transaction volume (such approach may be documented and agreed in the Application Form or otherwise).

4.4 How we may use the Reserve. You agree that we may apply funds represented by the Reserve at our sole discretion against any Expected Liabilities which you may owe us.

4.5 Receipt of Payment Transaction proceeds. You unconditionally agree and instruct us to transfer and hold the proceeds of any of your Payment Transactions we receive in one of our AB Customer Accounts or, if applicable, the Reserve Account

for the purpose of holding such funds until we Settle them to your Settlement Bank Account.

4.6 Settlement.

a) Unless otherwise agreed in writing, if your Settlement Proceeds exceed the equivalent of £20.00 in any one (1) day, we will transfer your Settlement Proceeds less the amounts we have deducted in accordance with clause 5.2 and kept as

part of the Reserve on a daily basis.

b) Unless otherwise agreed in writing, if your Settlement Proceeds do not exceed the equivalent of £20.00 in any one (1) day, any such Settlement Proceeds will be carried forward to subsequent days until the cumulative Settlement Proceeds

exceed the equivalent of £20.00. Such Settlement Proceeds will then be transferred to you in accordance with clause 4.6(a).

c) In the Agreement, the “Settlement Proceeds” are the proceeds of your Payment Transactions which we received as cleared by the Card and Payment Schemes on the day which, unless agreed otherwise in writing, is 7 days prior to the date we transfer your Settlement Proceeds to your Settlement Bank Account.

4.7 Payment of funds held as Reserve. You agree and instruct us not to transfer the Reserve held in the Reserve Account to your Settlement Bank Account until the later of the following (such a date to be a business day and the date on which we receive

your payment order to transfer such amounts):

a) the period for Chargebacks to be brought against the applicable Payment Transactions has expired; and

b) any and all Expected Liabilities that you may owe us under the Agreement have expired or paid in full.

Please note that following termination of the Agreement, we may hold your Reserve for a period of up to six (6) months.

4.8 Other security. If requested by us and agreed between the parties, you will provide us such other security or financial comfort as we may reasonably request to secure the performance of your obligations under the Agreement. This may involve you

arranging the execution of a guarantee, creating a trust account or placing a legal charge over a deposit in a bank account.

4.9 Invalid payment instructions. We are under no obligation to provide our Services with respect to a submission of Payment Transactions and/or Settlement (nor continue to provide our Services to a Payment Transaction and/or Settlement) if we

know or:

a) reasonably consider you to be in breach of the Agreement (or likely to become in breach of your obligations under the Agreement);

b) suspect there to be insufficient proceeds from your Payment Transactions to meet your Reserve requirements; and/or

c) suspect that Payment Transactions and/or Settlement Proceeds may be related to the commission of fraudulent activity or another offence.

Any payment instruction or order you provide us which falls within any or all of the above will be treated as invalid. We will notify you if we do not provide our Services to you on the basis of this clause, together with any reasons for taking such an action and if applicable, the procedure to rectify the situation (but only if we are not prohibited by any Laws or if it would not compromise any objectively determined security measures). We may re-commence providing our Services to you related to a Payment Transaction if we consider the circumstances set out in this clause 4.9 no longer exist.

4.10 Currency conversion. Unless otherwise agreed in writing, we do not perform currency conversions on the Payment Transactions you submit to us, nor on the amounts which are cleared and/or Settled via our Services. Currency conversions may be carried out by the Card and Payment Schemes and/or your financial institution that holds your Settlement Bank Account if you accept or deposit payments in currencies other than the Settlement Currencies.

4.11 No interest. We are not liable to you for any interest we may receive on any funds that we hold as part of your use of our Services. Any such interest earned is held solely to our account.

5 SERVICE FEES AND OTHER AMOUNTS PAYABLE BY YOU

5.1 Service Fees. In consideration for our provision of the Services, you will pay us the Service Fees and all other amounts which are due and/or payable by you in accordance with the terms of the Agreement.

5.2 Our right to deduct amounts you owe us. You agree that we can deduct amounts equal to the Service Fees, Chargebacks, Fines, Demands or Claims, Refunds and/or any other amount you may owe us, or any other amount that you have agreed with a Third Party Supplier that we may collect on their behalf from:

(a) the proceeds of your Payment Transactions but before those funds are credited to your MyAB Account. The details of the amounts you receive and our Service Fees can be accessed by logging into your MyABAccount;

(b) the Reserve; and/or

(c) if the proceeds of your Payment Transactions or the Reserve are insufficient, then via a direct payment by you to us (whether via the agreed direct debit mandate or otherwise).

In addition to the details we provide you in your MyABAccount, we will notify you if we deduct amounts relating to any Demands or Claims or other amounts which are owed to us (other than Service Fees, Chargebacks, Fines or Refunds) and the reasons for doing so.

5.3 Electronic invoice. You agree that we may send you an electronic invoice detailing the Service Fees you have paid us. In the absence of any contrary agreement, and where relevant, we will nominate the currencies (or currency equivalent) by which the Service Fees will be paid.

5.4 Chargebacks and Fines. You agree to be liable to us and pay us amounts which equal any and all Chargebacks and Fines and associated costs related to your use of our Services. Each Chargeback and Fine represents a debt immediately due and payable by you to us. As Chargebacks and Fines may present themselves some time following the applicable Payment Transaction, your liability to us for such an event will survive termination of the Agreement.

5.5 Chargeback and dispute procedures. You agree to process and handle any Chargebacks in accordance with applicable Card and Payment Scheme Rules (including, for example, any ‘Chargeback Guide’ which may be issued by a Card and Payment Scheme). You also agree to otherwise assist us or any Card and Payment Scheme with such information or co-operation as required to manage the handling of any claim or dispute raised by a Customer, Card and Payment Scheme or other third party in relation to any Payment Transaction. We will notify you as soon as reasonably practicable of a Chargeback or Fine that may apply to you and if you wish to dispute the Chargeback or Fine you acknowledge and agree that you are solely responsible for the dispute and proving any information requested by the relevant Issuer and/or Card and Payment Scheme. You also acknowledge and agree that the Card and Payment Scheme decision relating to all aspects of Chargebacks and Fines is final and binding.

5.6 VAT and Taxes. All sums (including Service Fees) referred to the Agreement are exclusive of VAT. Any VAT properly chargeable in respect of sums referred to in the Agreement are payable in addition to such sum at the relevant rate from time to time. Further, you agree to pay and be responsible for determining any and all taxes and/or duties assessed, incurred, or required to be collected, paid or withheld for any reason in connection with the sale or purchase of any products or services for a Payment Transaction, or otherwise in connection with any action, inaction, omission by you or any Affiliate of

5.7 Late payment interest. All amounts owed by you under the Agreement but not paid when due and payable, will bear interest from the date such amounts are due and payable at 2% per annum above the base rate of the Bank of England from time to time (accruing daily). This interest rate may vary without notice and apply with immediate effect when there is a change in the Bank of England base rate. Details of The Bank of England Base rate are accessible via: www.bankofengland.co.uk.

5.8 No set-off. In all cases, the amounts due under the Agreement by you to us will be paid by you to us in full without right of set-off or deduction.

5.9 Third party fees. When using our Services, you are responsible for any fees, costs, liabilities or other charges that may be levied by your Third Party Suppliers (which may include for example, telecommunication carriers that levy fees related to data and messaging services). Although you may have agreed with a Third Party Supplier that we may collect fees levied on you by the Third Party Supplier, you agree and acknowledge that we are not responsible nor liable for those fees or liabilities.

6 DURATION AND ENDING OF THE AGREEMENT

6.1 Initial Term. The Agreement will commence on the date you sign the Pricing Schedule (known as the “Effective Date”) and will continue, unless terminated earlier in accordance with the Agreement, for an initial minimum period expiring on the first anniversary of the Effective Date (the “Initial Term”).

6.2 Automatic extension of the Initial Term. The term of the Agreement will automatically extend for one (1) year (“Extended Term”) at the end of the Initial Term and at the end of each subsequent Extended Term, unless the Agreement is terminated earlier in accordance with its terms.

6.3 Your right to terminate for convenience with notice. You may terminate the Agreement at any time following the Initial Term by giving us two (2) month’s prior written notice.

6.4 Our right to terminate for convenience with notice. We may terminate the Agreement at any time by giving you at least two (2) month’s prior written notice.

6.5 Each party’s rights to immediately terminate the Agreement. Without prejudice to any rights that have accrued under the Agreement, or any of party’s rights or remedies, either party may at any time terminate the Agreement with immediate effect by giving written notice to the other party if:

a) the other party commits a material breach of any term of the Agreement and (if such breach is remediable) fails to remedy that breach within a period of 30 days after being notified in writing to do so;

b) the other party repeatedly breaches any of the terms of the Agreement in such a manner as to reasonably justify the opinion that its conduct is inconsistent with it having the intention or ability to give effect to the terms of the Agreement;

c) the other party is subject to a Bankruptcy, Insolvency, Winding up or other similar Termination Event; and/or

d) the result of Laws, Card and Payment Scheme Rules, Regulatory Authority rules or guidance or any change in or any introduction thereof (or change in the interpretation or application thereof) means that it is unlawful or contrary to any such law, rules, order or regulations for either of the parties to perform or give effect to any of its obligations hereunder and such obligation cannot be readily severed from the Agreement.

6.6 Our right to immediately terminate the Agreement. Without prejudice to any rights that have accrued under the Agreement or any of the party’s rights or remedies, we may at any time terminate the Agreement with immediate effect by giving written notice to you if:

a) there is a change of control of you or you dispose of a substantial part of your assets. In this clause, “control” means the possession by any person(s) or nominee(s) directly or indirectly of the power to direct or cause the direction of another person and “change of control” is construed accordingly;

b) we are unable to verify your information in the manner set out in clause 2.4;

c) you are an individual and you die or you are a partnership and your partnership ends;

d) your agreements with your Third Party Suppliers used in connection with your use of the Services terminate or we consider the terms which you have entered into with such Third Party Suppliers are unacceptable, and/or such supplier fails to comply with any Card and Payment Scheme Rules, Merchant Operating Procedures and/or PCI Compliance Standards (as the case may be);

(e) your Third Party Supplier used in connection with your use of the Services is subject to a Bankruptcy, Insolvency, Winding up or other similar Termination Event;

(f) we have reason to believe that your business and/or use of our Services: damages, corrupts, degrades, destroys and/or otherwise adversely affects the Services, or any other software, firmware, hardware, data, systems or networks accessed or used by you;

(g) there is a material change in the type of business activities you carry out, including such a material change in the goods and services you sell to Customers;

(h) there is a significant fluctuation (either positive or negative) in the aggregate number of Payment Transactions you receive or in the average Payment Transaction amount (for example you have not submitted any Payment Transactions for six (6) consecutive months and you have not notified us of a good reason why);

(i) you receive a significant amount of Chargebacks such that your ratio of Chargebacks to Payment Transactions exceeds 1% at any time or which are not otherwise within usual ranges for businesses of a similar size and nature as your own;

(j) you incur any Fine;

(k) we are unable to enforce any security interest we may have been granted in connection with your use of our Services and/or you withdraw your consent to us holding Reserves in the Reserve Account and/or AB Customer Account;

(l) there is a significantly adverse decrease in your business operations, revenues, profits or financial position;

(m) you have breached clause 7 (Data Security and Privacy) and/or any information you submit to us or any of the warranties you provide us in the Agreement are found to be untrue or misleading;

(n) you use our Services on an incompatible Merchant System as referred to in clause 2.9(a);

(o) you, your Affiliates and/or Third Party Suppliers have acted or omitted to act in any way which we reasonably determine to diminish our, our Affiliates and/or any Card and Payment Scheme’s, business operations and/or reputation and/or goodwill and/or which we reasonably determine or suspect to give rise to any offence or any increased risk or liability to us; and/or

(p) we are unable to provide the Services to you through the inability of any Card and Payment Scheme or Third Party Supplier to provide us with any good and/or service that we require to provide the Services to you (including any notice given to us by a Card and Payment Scheme to terminate our relationship with you).

6.7 Other actions we may take. If you have breached the terms of the Agreement (including a breach of your obligation to pay us any amount owing), we are otherwise entitled to terminate the Agreement, or if other terms of the Agreement otherwise permit us to do so, we may:

a) suspend your use of our Services (in whole or in part) in which case we will not treat any Payment Transaction orders that you may wish to make as being received by us;

b) report any Payment Transaction, Data and/or any other relevant information about you and your use of our Services to the relevant Regulatory Authority, law enforcement agency and/or government department; and/or

c) if appropriate, seek damages from you.

6.8 Stopping our support of a Card and Payment Scheme. We may decide to suspend or cancel our support of a particular Card and Payment Scheme (and/or any or all associated payment methods) without liability to you if any of the following events occur during the term of the Agreement:

a) a Card and Payment Scheme imposes changes to their arrangements with us which are material and detrimental to our providing our Services to you;

b) a Card and Payment Scheme is in material breach of any obligation it owes us;

c) we reasonably suspect that there is a material adverse change in the credit worthiness of a Card and Payment Scheme; and/or

d) a Card and Payment Scheme sharply increases its costs, charges and/or fees on any of its relevant payment methods.

In the event of any of the circumstances occurring as set out in this clause, we will use our reasonable endeavours to notify you at least one (1) month in advance of any change to our support of any Card and Payment Scheme and/or associated payment method.

6.9 Consequences of breach of a Card and Payment Scheme Rule. If you are in breach of any Card and Payment Scheme Rule, upon our notification, you must immediately cease any actions or omissions in any location which cause you to be in

breach of the Card and Payment Scheme Rule.

6.10 Your obligation to inform us of certain events. You undertake to immediately notify us if you reasonably suspect any event or proceeding as set out in clauses 6.5(c) and 6.6 is likely to occur (or has occurred).

6.11 Consequences of termination. Termination of the Agreement, for any reason, does not affect the accrued rights, remedies, obligations or liabilities of the parties existing at termination (including your obligation to pay our Service Fees and

automatically resolve any dispute where you may be involved). Other than as set out in the Agreement, neither party has any further obligation to the other under the Agreement after its termination.

6.12 On termination of the Agreement:

a) you must cease using our name, the name of any Card and Payment Scheme and must remove all of our trademarks, logos and any or all materials referencing the Card and Payment Schemes. You agree to immediately return to us any

materials containing our or a Card and Payment Schemes names;

b) you must immediately pay to us all amounts owed by you to us under the Agreement (including any Service Fees which are apportioned as due from you up until the time of termination) and we will immediately pay you all amounts owed

to you by us under the Agreement (including any Service Fees paid in advance to be re-imbursed proportionately), but in all circumstances subject to the provisions of clauses 4 (Processing your Payment Transactions and Settlement)

and 5 (Service Fees and other amounts payable by you), including our ability to hold onto the Reserve;

c) all licences granted by us under the Agreement terminate immediately and (if applicable) you must cease use of all our Services; and

d) we have no responsibility to you to supply you with the details of any Data, nor have it stored or otherwise held for you.

6.13 Provisions which remain in force after termination. Any provision of these Terms or as set out in the Agreement which expressly or by implication is intended to come into or continue in force on or after termination of the Agreement, including this clause

6, clause 1 (Our Services), clause 4 (Processing your Payment Transactions and Settlement) clause 5 (Service Fees and amounts payable by you), clause 7 (Data Security and Privacy), clause 9 (Intellectual Property and promotional matters), clause 10 (Compensation), clause 11 (Liability), clause 12 (Warranties and important disclaimers), clause 13 (Confidential Information), clause 17 (Governing law and jurisdiction), clause 19 (Other Important terms) and clause 20 (Defined Terms

Explained) remain in full force and effect.

7 DATA SECURITY AND PRIVACY

7.1 Keeping Customer Data secure. You are responsible and must ensure that any Customer Data which you store (or which a third party stores on your behalf) is held securely and in accordance with Card and Payment Scheme Rules, the Merchant

Operating Procedures, PCI Compliance Standards and applicable Laws and you agree (and will procure that any relevant third party will) be bound by and comply with the terms of the same. You must not sell, purchase, provide, exchange or in any manner disclose Payment Transaction details of a Customer (for example, a card account number or other personal data related to a Customer) to anyone other than us, the applicable Card and Payment Scheme or in response to a valid regulatory demand. In providing the Services we are responsible for the security of Customer Data we possess or otherwise store, process or transmit on your behalf, or to the extent that we could impact the security of your Customer Data environment.

7.2 Security audit. We may require that you may not store any Customer Data on any server maintained by yourself or any third party, without first undergoing, at your own cost, a security audit which should be carried out by one of our approved security auditors.

7.3 You must notify us immediately of a security breach. You must notify us immediately if you become aware of or suspect any security breach relating to Customer Data (even if you consider yourself to be in compliance with the PCI Compliance Standards). You must also immediately identify and remedy the security breach of the Customer Data.

7.4 Appointment of a forensic investigator. If a Customer Data security breach occurs (whether caused by yourself or a third party you are using), you will be liable for any costs and fines. If it is identified that a Customer Data security breach can be

tracked back to your business, you agree, at our request and at your cost, to appoint a third party forensic investigator. You are also responsible for any or all costs associated with the investigation and any changes that are required for you to meet

compliance with PCI Compliance Standards and the terms of the Agreement.

7.5 Special meaning of words used in this clause. For the purpose of this clause 7, the terms: “data controller”, “data processing”, “data processor”, “data subject”, “processing” and “personal data” have the meanings ascribed to them in the Data

Protection Act 1998. The term “store” has the same meaning as set out in the PCI Compliance Standards.

7.6 Our Privacy Policy. To the extent that we are the data controller of any personal data which forms part of the Customer Data, the means by which we will process the personal data is set out in our Privacy Policy which is made available via

www.abfx.com. You authorise us to submit any and all information you supply us (including the information you provide us in the Application Form) to the Card and Payment Schemes to obtain their permission to allow you access to their applicable scheme and payment networks. Any information we may collect from you (including Customer Data) may be transferred to, processed at, or stored outside the EEA.

7.7 Our role as data processor. To the extent that our performance of our obligations under the Agreement involves the processing of personal data in respect of which you purport to be the data controller, we will be a data processor in respect of such personal data and will accordingly:

a) only act on your instructions regarding the processing of personal data under the Agreement and ensure that appropriate technical and organisational measures are taken against unauthorised or unlawful processing of the personal data and against accidental loss or destruction of, or damage to, the personal data;

b) from time to time comply with any reasonable request made by you to ensure compliance with the measures contained in 7.7(a);

c) take the measures mentioned in clauses 7.7(a) and (b) having regard to the state of technological development and the cost of implementing the measures, so as to ensure a level of security appropriate to:

(i) the harm that may result from breach of such measures; and

(ii) the nature of the personal data to be protected;

d) be fully responsible for the reliability of any of our employees or sub-contractors who have access to the personal data provided by you; and

e) respond to and supply such information to you as reasonably required to respond to any requests made by data subjects or enforcement agency in respect of the processing of the applicable personal data.

7.8 Your other privacy obligations.

You:

a) will ensure that you have outlined in a complete and accurate manner, your use of Customer Data within your use of our Services in your privacy and related policies and have obtained all necessary consents from data subjects to allow their data to be processed as contemplated by the Agreement;

b) will provide the personal data to us together with such other information as we may reasonable require in order to provide the Services;

c) warrant, represent and undertake that any instructions given by you to use the personal data and/or the supply of any personal data to us by or on your behalf will at all times be in accordance with Laws and that compliance with such instructions will not place us in breach of any Laws, the Agreement and/or Card and Payment Scheme Rules;

d) will not, at any time, store any Data that a Card and Payment Schemes may classify as Data which is prohibited from being stored. This includes:

(ii) payment card verification value highlighted in the magnetic stripe;

(ii) payment card verification value highlighted on the payment card in or next to the signature placeholder;

(iii) payment card verification value contained in the magnetic stripe image in a ship application;

(iV) PIN verification value contained in the magnetic stripe; and/or

(V) any or all information of any track from the magnetic strip (whether on a payment card, in a chip or elsewhere).

e) will inform data subjects (at a minimum) of their right to:

(i) request access to and receive information about their personal data maintained by us; update and correct any inaccuracies in their personal data; have their personal data blocked or deleted (in compliance with Laws);

(ii) withdraw any consent they previously provided or object to their processing of personal data at any time by providing legitimate reasons;

(iii) be informed about the choices and means that data subjects have for limiting the processing of personal data; and

(iV) be informed about the categories of recipients of personal data.

f) must not compile or use any lists of Customer Data or other information referred to in this clause 7 other than for the proper use related to your compliance with the terms of the Agreement.

8 RECORDS AND GENERAL AUDIT RIGHTS

8.1 Access to Payment Transaction and other data. Unless your MyAB Account is fully restricted, you can access your details of executed Payment Transactions and other information relating to your MyAB Account transaction history by logging into your MyAB Account. You agree to review your transactions through your MyAB Account transaction history instead of receiving periodic statements by mail. Key information relating to your Payment Transactions will be provided to you via your Payment Transaction history and will also be updated and made available to you by logging into your MyAB Account. You will also be able to access a downloadable report via the “<History>” section of your MyAB Account. The “<History>” section will also show all Service Fees incurred and any other amounts charged in the relevant period. The <“History”> will only be updated and consequently made available if there have been Payment Transactions or any Service Fees have been incurred in the relevant period. The way in which we provide the transaction information will allow you to store and reproduce the information unchanged, for example by printing a copy or downloading a pdf version. We will ensure that the details of each Payment Transaction will be made available for you to view online for at least thirteen (13) months from when it is first made available.

8.2 You must keep your own records and notify us of any errors or unauthorised activity. You are responsible for maintaining your own records with respect to Payment Transactions and any other associated Data that we make available to you under the Agreement and for reconciling such information with your own records. You must notify us as soon as possible (and no later than thirteen (13) months after the relevant Payment Transaction date) of any unauthorised or incorrectly executed Payment Transactions reflected in your MyAB Account.

8.3 Data retention. You agree to store and keep secure legible copies of all relevant Data for a period of at least five (5) years following the Payment Transaction associated with the Data, in a manner and form permitted under the Card and Payment Scheme Rules and PCI Compliance Standards. This requirement to store and keep copies of the Data is in addition to your obligations to retain such information under applicable Laws.

8.4 General audit rights. Without prejudice to the privacy and security audit provisions in clause 7, you will permit us (or our authorised representatives or the applicable Card and Payment Scheme) to audit your procedures, records and performance related to any matter referred to in the Agreement in such a manner as we may reasonably consider appropriate. You agree to co-operate in any audit request and to provide reliable truthful and complete answers to any questions raised during an audit. We may retain copies of records which we ascertain during the course of any audit, such copies to be considered “Confidential Information” for the purpose of the Agreement. Each party will bear their own costs with respect to complying with the auditing provisions of this clause 8.

9 INTELLECTUAL PROPERTY AND PROMOTIONAL MATTERS

9.1 Display of Card and Payment Scheme logos. By using our Services to accept Card and Payment Scheme Payment Transactions, you must clearly display the details of your acceptance of such Card and Payment Schemes (including the use of any Card and Payment Scheme logo or trademark) in the manner and form as we notify to you and in compliance with the Card and Payment Scheme Rules. This may include you displaying the logo or trademark of a Card and Payment Scheme (or a combination thereof) in a prescribed manner at various interactive points in your Customer promotion and sale process and when payment options are presented to your Customers.

9.2 Our and the Card and Payment Schemes ownership of Intellectual Property Rights. All of our or the Card and Payment Scheme’s Intellectual Property Rights used by you (and any of our Intellectual Property Rights created or derived therefrom) remain the property of or vest in, (as the case may be) us, the applicable Card and Payment Scheme and where appropriate one of our Affiliates or an authorised licensor. Unless expressly provided in the Agreement, nothing in the Agreement will be interpreted as granting you a licence to use any of our and/or a Card and Payment Schemes Intellectual Property Rights.

9.3 No transfer of Intellectual Property Rights. The Agreement does not assign any of our or a Card and Payment Scheme’s Intellectual Property Rights existing as at the Effective Date, nor does it assign any Intellectual Property Rights which are created or developed by or on our or a Card and Payment Scheme’s behalf during the term of the Agreement or otherwise. You acknowledge and agree that you do not acquire any ownership rights by downloading material which is copyrighted (or subject to any other form of Intellectual Property Right).

9.4 Use of logos and trademarks. Each party grants the other party (and to the Card and Payment Schemes) a fully paid up, limited, non-exclusive, personal and non-transferable licence to use its logo(s) and trademarks (i) for the purpose of performing their obligations under the Agreement; and (ii) you allow us (and the Card and Payment Schemes) to use your

name or logo to identify you as a participating merchant of our, and the Card and Payment Scheme, Services (including in marketing materials). Except as licensed here, each party retains all right, title, goodwill, and interest in and to its trademarks and logo(s). In using each other’s trademarks or logos, the parties will follow any guidelines for logo or trademark usage provided by the owner of the trademark or logo being used.

9.5 Restrictions. Except as expressly permitted by us in writing, you may not, and may not attempt to, directly or indirectly:

a) modify, alter, tamper with, translate, repair, display, reverse engineer, disassemble, decompile, perform, reproduce, create derivative works from, attempt to ascertain or list the source programs or source code or in any way exploit any of our or a Card and Payment Scheme’s Intellectual Property Rights; nor

b) transfer, sub-license, loan, sell, assign, lease, rent, distribute or grant rights in full or in part to any person or entity in our Service and/or our or a Card and Payment Scheme’s Intellectual Property Rights.

10 COMPENSATION

10.1 Meaning of the word “indemnity”. In this clause we use the legal term: “indemnity” which, in general terms, is used to mean when a sum is paid from one person to another for loss suffered by the others.

10.2 You indemnify, defend and hold us and our Affiliates (and their respective directors, officers, owners, co-branders or other partners, information providers, licensors, licensees, consultants, employees, independent contractors agents and other applicable third parties) (each an “Indemnified Party”) from and against all claims, demands, causes of action, debts, judgments, liabilities, costs, penalties, interest, taxes, expenses, damages and losses (including any direct, indirect or consequential losses, loss of profit, loss of reputation and all interest, penalties and legal and other professional costs and expenses) (collectively “Losses”) suffered or incurred by an Indemnified Party arising out of, as a result of, related to, or in connection with:

a) the actual or alleged breach, or negligent performance, or non-performance, or delay in performance of the Agreement (including a breach of clause 7 (Data security and Privacy)) by you, your employees, agents or sub-contractors or the warranties, representations, covenants, certifications, acknowledgments and/or obligations made by you in the Agreement;

b) a Payment Transaction, Pre-approved Payment, Refund, Chargeback, Fine;

c) any Card and Payment Scheme Rules;

d) you being in alleged or actual breach of any Laws or failure to comply with any Regulatory Authority;

e) your breach or negligent performance or non-performance or delay in performance of any agreement or other legal relationship you have entered into with your Customers or Third Party Suppliers;

f) our acting on the instructions of your Third Party Suppliers (including if we collect your fees on behalf of agreements you have with your Third Party Suppliers);

g) your business operations, a dispute you have with your Customers, the goods and/or services you supply and/or their delivery;

h) any claim made against us for actual or alleged infringement and/or violation of our or a third party’s Intellectual Property Rights and/or proprietary rights (including actual or alleged infringement of any applicable licensing requirement) arising out of or in connection with your use of the Services;

i) us defending or being joined as party in any proceedings related to the customer/service provider relationship between you and your Customers or the relationship between you and your Third Party Suppliers and/or any damages awarded against us in respect of any such proceedings;

j) any claim arising out of our permitted use, promotion or distribution of the information, related trademarks and logos, or images and other materials that you provide us;

k) your wrongful or improper use of the Services, the goods and/or services you provide; and/or

l) the enforcement (or attempted enforcement) of the Agreement.

10.3 Our right to deal with any claim. You agree that we are entitled in our sole and absolute discretion to accept, dispute, compromise or otherwise deal with any claim, alleged claim, loss or liability which is made against us.

11 LIABILITY

11.1 Liability not excluded under the Agreement. Notwithstanding any other provision of the Agreement, neither party excludes or limits liability to the other party for:

a) fraud or fraudulent misrepresentation;

b) death or personal injury caused by negligence;

c) a breach of any implied condition as to title, encumbrances and/or quiet enjoyment; or

d) any matter for which it would be unlawful for the parties to exclude liability.

11.2 Matters we are not liable. Subject to clauses 11.1, 11.3, 11.6, 11.7 and 11.8, we are not in any circumstances liable whether in contract, tort (including for negligence and breach of statutory duty howsoever arising), misrepresentation (whether innocent or negligent), restitution or otherwise, for:

a) any loss (whether direct or indirect) of profits, sales, business, business opportunities, revenue, turnover, reputation or goodwill;

b) any loss or corruption (whether direct or indirect) of data or information;

c) any loss (whether direct or indirect) of anticipated savings or wasted expenditure (including management time);

d) any loss or liability (whether direct or indirect) under or in relation to any other contract; and/or

e) any other special, indirect or consequential losses.

11.3 Matters where we are liable. Nothing in this clause 11 excludes or limits our liability to you for the following:

a) the correct execution of a Refund unless we can demonstrate to your Customer and/or your Customer’s applicable Issuer or other payment service provider that they received the Refund payment amount in accordance with clause 18.10 (Execution times);

b) charges you are responsible for, and any interest you may have to pay as a result of our non-execution and/or defective execution of a validly submitted Payment Transaction;

c) for the transmission in accordance with applicable Laws of a Payment Transaction order where you have validly initiated the payment as the intended recipient of the funds which are the subject of the Payment Transaction.

11.4 Clause 11.2 does not prevent claims, which fall within the scope of clause 11.5 for direct financial loss that is not excluded under any of the categories set out in clause 11.2.

11.5 Our liability cap. Subject to the other sub-clauses of this clause 11 our total aggregate liability (whether the liability arises in contract, tort (including negligence and breach of statutory duty howsoever arising), misrepresentation (whether innocent or negligent but not fraudulent), restitution or otherwise), arising in connection with the performance or contemplated performance of the Agreement or any collateral contract is limited to an amount equal to the total Service Fees due to us or paid under the terms of the Agreement during the six (6) month period immediately preceding the event giving rise to the claim for liability.

11.6 Your liability cap for unauthorised Refunds. With regard to an unauthorised Refund, you are only liable to us for up to £50 unless you have acted fraudulently or you intentionally or with gross negligence violated clauses 3.2 (Appointing Authorised Logins) and/or 3.3 (Your security obligations).

11.7 Non-execution or defective execution of Payment Transactions initiated by you when you:

a) Give the payment order (eg when you executed a Refund). A Payment Transaction which is executed by us, will be considered as correctly executed when we do so with the details provided by you under the terms of the Agreement. We will not be liable to you for the non-execution or defective execution of such payment transactions where you provide us with incorrect details, however, we may seek to assist you in recovering the funds (for example from another payment service provider) and if we do so, we may charge you a fee. Notwithstanding the foregoing we will, at your request, make immediate efforts to find a non-executed or defectively executed payment transaction referred to in this clause (e.g. a Refund) and notify you on what we discover. If we are unable to prove that the recipient’s payment service provider received the payment transaction then we will (and without undue delay) refund to you the amount of such a payment transaction and make corresponding corrections to the information contained in your MyAB Account. If we are not liable, the recipient’s payment service provider might be, and if so, it must make available the amount of the payment to the recipient and where applicable, credit their payment method with the corresponding amount.

b) Are the intended recipient of the funds. Where you correctly initiate a payment as a payee (such as when you are the intended recipient of the funds), we are responsible under Laws to correctly transmit your payment order. If we are liable for any non-executed or defectively executed payment order under this clause, we will immediately re-transmit the payment order and undertake other activities to track the payment as well as come back to you with information we find out following our investigations. If we discover that we are not liable, it may be that your Customer’s or other applicable person’s payment service provider is responsible in which case they are liable to pay you the amount of the incorrectly or defectively executed payment transaction and restore your MyAB Account balance in a manner to reflect your payment transactions as if it had not taken place.

11.8 No liability due to your failure to comply with the Agreement or events outside our control. We have no liability to you for any failure or delay in performing our obligations under the Agreement if such failure or delay is caused by your acts, omissions or results from actions taken by us in good faith to avoid being in breach of any Laws, Card and Payment Scheme Rules or is otherwise caused by acts or omissions of third parties or circumstances beyond our reasonable control.

12 WARRANTIES AND IMPORTANT DISCLAIMERS

12.1 Warranties provided by you. Unless expressly agreed otherwise in writing, you represent, undertake and warrant to us at the Effective Date and each time you use our Services that you are a Merchant with your registered office and/or who carries out your key business activities within the EEA and that you have the right, power, ability, full capacity and authority to enter into and perform your obligations under the Agreement.

12.2 We are not responsible for the underlying sales transaction. We are not a party to a sales contract, promotion or loyalty/reward programme between you and your Customers (prospective or otherwise) and we will not mediate disputes between you and your Customers nor enforce or execute the performance of any sales, offer or loyalty/reward programme contract. You are responsible for ensuring that your use of our Services is not inconsistent with any other agreement you may have entered into with your Customers.

12.3 We are not responsible for Third Party Suppliers. You are solely responsible and liable for (and we are not responsible or liable for) your communications, contracts, agreements, arrangements and/or disputes with and/or entered into with Third Party Suppliers. Any such matters are specifically and solely between you and the applicable Third Party Supplier. Any warranties or representations made with regard to any Third Party Supplier and their business or any products or services are made by the applicable Third Party Supplier only, and not by us. You acknowledge that the applicable Third Party Supplier is solely responsible for the goods and/or services provided by them and for its products and services quality, suitability and fitness for purpose. You agree to release us, our Affiliates and our and their respective directors, officers, employees, owners, licensors and agents from all claims, demands and damages (actual and consequential) of any kind and nature, known and unknown, suspected and unsuspected, disclosed and undisclosed, arising out of or in any way connected with any communications, organised activities or disputes between you and any Third Party Supplier.

12.4 General disclaimer. Our Services (including all content, functions, materials and information made available on, provided in connection with or accessible through the MyAB Account) are provided on an “as is” basis. To the fullest extent permitted by applicable Laws and under all circumstances other than those expressly made in the Agreement, we, our Affiliates, and their agents, co-branders or other partners (collectively, “Our Associated Parties”) make no conditions, representations or warranties of any kind, express or implied, howsoever regarding the Services including:

(ii) any implied conditions, representations and/or warranties of merchantability, satisfactory quality, and/or fitness for a particular purpose; and/or

(ii) that our Services will meet your requirements, be compatible with your Merchant Systems, any Equipment or will contain any particular features or functionality.

12.5 Our right to conduct Service maintenance. From time to time, we may carry out maintenance of our Services which may result in certain parts of our Services not being available or accessible, in which case we endeavour to give you advance notice via e-mail or your MyAB Account.

12.6 You are responsible for implementing safeguards when using our Services. While we endeavour to maintain an uninterrupted Service, and except as expressly provided for in the Agreement and as required by applicable Laws, we do not guarantee your access to our Services will be delivered uninterrupted, securely, timely or error-free, or that the Services will be free from viruses or other harmful properties. It is your responsibility to implement satisfactory safeguards and procedures to make sure any files you obtain through our Services are free from contaminations or other harmful properties.

13 CONFIDENTIAL INFORMATION

13.1 Each of the parties will keep confidential and will not disclose to any person any information, whether in written or any other form, disclosed to it ("receiving party") by or on behalf of the other party ("disclosing party") in the course of the discussions leading up to or the entering into or performance of the Agreement and which is identified as confidential or is clearly by its nature confidential (“Confidential Information”) except insofar as the Confidential Information:

a) is required by a person employed or engaged by the receiving party in connection with the proper performance of the Agreement; or

b) is required to be disclosed by law, provided that the party disclosing the information notifies the other party of the information to be disclosed and of the circumstances in which the disclosure is alleged to be required as early as reasonably possible before such disclosure must be made and will take all reasonable action to avoid and limit such disclosure.

13.2 Confidential Information includes information relating to:

a) Customers and their Payment Transactions (including where appropriate, any ‘hot card file information’); and

b) our business, the Merchant Operating Procedures, the Card and Payment Schemes and the Card and Payment Scheme Rules.

13.3 Any disclosure of Confidential Information permitted under the Agreement will be in confidence, will only be to the extent that any persons to whom the information is disclosed need to know the same for the performance of their duties in accordance with the Agreement and the receiving party is obliged to procure that all such persons are aware of the obligation of confidentiality and undertake to comply with it.

13.4 Each party hereby undertakes to the other to use the Confidential Information disclosed to it by or on behalf of the other party solely in connection with the performance of the Agreement and not otherwise for its own benefit or the benefit of any third party.

13.5 Confidential Information does not include information which:

a) is or becomes generally available to the public otherwise than as a direct or indirect result of disclosure by the receiving party or a person employed or engaged by the receiving party contrary to their respective obligations of confidentiality; or

b) is or was made available or becomes available to the receiving party otherwise than pursuant to the Agreement and free of any restrictions as to its use or disclosure.

13.6 Notwithstanding the above, nothing in the Agreement prevents us from utilising your information (including your Confidential Information) for the purposes of carrying out our Services as required to liaise with the Card and Payment Schemes or any other financial or credit institutions, or as set out in our Privacy Policy.

13.7 Without prejudice to any other rights or remedies that the disclosing party may have, the receiving party acknowledges and agrees that if the Confidential Information is used or disclosed other than in accordance with the terms of the Agreement, the disclosing party is, without proof of special damage, entitled to seek an injunction, specific performance or other equitable relief for any threatened or actual breach of the provisions of this clause 13, in addition to any damages or other remedy to which it may be entitled.

14 CHANGING OUR TERMS

14.1 From time to time, we may wish to change these Terms.

14.2 Our right to amend by providing two (2) months prior notice. We may vary these Terms by giving you at least two (2) months prior written notice (“Change Notice”) or otherwise with your agreement in writing. If we provide you with a Change Notice, you are entitled to terminate the Agreement immediately, without charge, by providing written notice to us, provided you provide such notice within the notice period we give you before the applicable variation of the Terms becomes effective. Following the expiration of our Change Notice (and if you have not terminated the Agreement before the Change Notices’ expiration), you will be deemed to have accepted the changes to the Terms on the date the applicable variation becomes effective.

14.3 Amendments to other important documents. Amendments to other terms, documents and policies (including Card and Payment Scheme Rules) are amended in accordance with their governing terms. Please note that changes to the Card and Payment Scheme Rules may occur immediately.

15 NOTICES

Any notice or other communication required to be given under the Agreement or under Laws must be given by email or post addressed to the other party at its address contained in the Application Form or such other addresses as notified to the other for the purposes of the Agreement. You agree to maintain a valid email address and access to the Internet to receive notices under the Agreement. Any notice sent by email will be deemed received one (1) hour after being sent, or if sent after 5pm, at 9am the next Working Day - provided that an undeliverable receipt has not been returned to the sender by this time. Any notice so given by post will unless the contrary is proved, be deemed served at the expiry of three (3) Working Days after it is posted and in proving such posting it will be sufficient to prove that the envelope containing the notice was properly addressed and posted as a first class pre-paid letter.

16 DISPUTE RESOLUTION AND COMPLAINT HANDLING

16.1 Please contact us in the first instance. In the event of any dispute or difference or claim howsoever arising between you and us in connection with or in relation to the Agreement, including any dispute regarding the existence, validity or interpretation of the Agreement you should, in the first instance contact us via This email address is being protected from spambots. You need JavaScript enabled to view it.. We endeavour to respond to any complaint or dispute as quickly as possible and with a view to finding a satisfactory solution.

16.2 Out of court dispute resolution. If you wish to escalate a dispute you have with us, you may seek settlement of that dispute by mediation in accordance with the London Court of International Arbitration's Mediation Rules, which rules are deemed to be incorporated by reference into this clause. This clause in no way restricts the rights of either party to proceed directly to Court proceedings to resolve any dispute. The language to be used in the mediation is English.

17 GOVERNING LAW AND JURISDICTION

The Agreement (including these Terms) is governed by the laws of England and Wales and any dispute between us unresolved by the process set out above will then be resolved exclusively in the Courts of England and Wales.

18 REGULATORY DISCLOSURES