ABPAY (22)

Complaints Handling

Our Commitment to You

We are committed to providing an excellent customer experience for all our Customers. If we do not meet your expectations in any way, we want to have the opportunity to put things right.

In the first instance, your initial communication will be with our Customer Services Team who can be contacted by email to This email address is being protected from spambots. You need JavaScript enabled to view it.

Our Customer Services Team will listen to your needs and will do their best to solve your issue promptly and fairly. We value the opportunity to review the way we do business and help us meet our customers’ expectations.

Complaints Handling

If having received a response from our Customer Services Team you are unhappy with the outcome, please contact the Complaints Team of A&B General (UK) Limited, 2nd floor Greenwich Quay Clarence Road London, SE8 3EY in writing via email on This email address is being protected from spambots. You need JavaScript enabled to view it.

Once received, the Complaints Team will conduct an investigation and you will receive a response of its findings within 15 days of receipt of the complaint. In exceptional circumstances where we are unable to reply within the first 15 days, we will reply providing a reason for the delay and deadline for response, of not more than 35 days after first receipt of complaint.

Financial Ombudsman Service

If you are still not satisfied, then you have the right to escalate your complaint to the Financial Ombudsman Service. The Financial Ombudsman is an independent body that deals with consumer complaints on financial services and products in the UK. You can contact them on 0800 023 4 567, through their website @ https://help.financial-ombudsman.org.uk/help or in writing to:

The Financial Ombudsman Service Exchange Tower London E14 9SR

A&B General (UK) Limited - Terms and Conditions

IMPORTANT INFORMATION: These are the terms & conditions of the agreement between us, A&B General (UK) Limited, 2nd Floor Greenwich Quay Clarence Road London SE8 3EY UK and you, the person entering into the agreement in relation to your Prepaid MasterCard® P lease read this Agreement carefully before activating your Account. The terms of this Agreement and fees shall apply to all Customers.

1. Definitions & Interpretation

"Account" a non-deposit non-interest bearing pre-paid electronic account associated with a Card and maintained for the sole purpose of enabling Transactions;

"Account Closure" a fee for redemption where specified in the Fees and Limits Schedule;

"Additional Card" Where applicable any additional card which is issued to a person any time after the successful registration of an Account;

"Additional Where applicable a person who holds an Additional Card; Cardholder"

"Agreement" this Agreement of open-ended duration between you and us incorporating these terms and conditions, as amended from time to time;

"Authorised" act of authorising the payment transfer by using the Card together with (i) the PIN Code or with (ii) the CVC Code and expiry date or with (iii) the signature of the Cardholder;;

"Available Balance" the value of unspent funds loaded onto your Account and available to use;

"Card" a physical device bearing electronically stored monetary value asrepresented by a claim against A&B General; and/or

a physical or digital mechanism providing access to an Account which is issued by A&B General Ltd for the purpose of enabling Transactions

"Customer" the person who has applied successfully for a Payment Service and has been issued at least one Card by us and who is the

legally and financially responsible person to whom the Payment Services are provided by Us;

"Business Day" Monday to Friday, 0900hrs to 1800hrs GMT, excluding bank and public holidays in the United Kingdom

"Fees & Limit the schedule contained at www.abmoneyplus.com and www.ab-money.co.uk

"Fee" any fee payable by the Customer, as referenced in the Fees & Limits Schedule; a pre-paid instant issue non-personalised card that can be used subject to the lower

"Instant Card" specified Instant Card limits on loading, transactions and redemption;

"KYC" regulated entities or for regulated person activities;

“KYB” regulated entities or for regulated business activities;

"Limitation Period" means the period of 6 years following termination of this Agreement;

"Merchant” a retailer or any other person that accepts e-money;

"Payment Services” means all payment and e-money services and any related services available to the Customer and/or Additional Cardholder(s) through the use of the Account and/or Card;

"Personalised Card” a physical pre-paid personalised payment card which may be used for on-line and off-line Transactions;

"Primary Card" Where applicable the first Card issued by us to the Customer in response to registration of the Account;

"Reload" to add money to your Account;

"Systems" MasterCard as shown on your Card;

"Transaction" realising or attempting to make: (i) a payment, or a purchase of goods or services from a Merchant where payment is made (in whole or in part) by use of the Payment Services, including where payment is made over the internet, by phone or mail order or (ii) a cash withdrawal made from an ATM or bank using your

Personalised Card plus any transaction fees charged by ourselves or any third party in connection with your cash withdrawal;

"Username/Password" a set of personal codes selected by the Customer to access their Payment Services;

"Virtual Card" Where applicable a non-physical pre-paid electronic payment card, the use of which is limited to on-line purchases or on the phone or mail order;

"we", "us" or 'our" A&B General (UK) Limited as the e-money issuer;

"you" or "your" The Customer and/or any person who has been provided with a Card by the Customer for use as an Additional Cardholder in accordance with these Terms and Conditions.

2. Contact Us

Your Cards can be managed online at www.abmoneyplus.com and www.ab-money.co.uk or call +44 (0) 203 355 9660 to report your Cards lost or stolen or email This email address is being protected from spambots. You need JavaScript enabled to view it.

At any time during the contractual relationship you shall have the right to receive, on request, these terms and conditions free of charge.

3. Your Agreement, Card and Account

Your Card is issued and the Payment Services are provided by A&B General (UK) Limited, a company incorporated under the laws of England & Wales with its registered trade office at 2nd Floor Greenwich Quay Clarence Road London SE8 3EY, UK

3.1 Company registration number 0928080, Authorised and regulated as an Authorised Payment Service and by the Financial Services Authority, 25 The North Colonnade, Canary Wharf, London, E14 5HS. Web: www.ab-money.co.uk E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

3.2 Details of A&B General (UK) Limited authorisation by the Financial Service Authority are available http://www.fsa.gov.uk/register//firmsearchForm.do

3.3 A&B General (UK) Limited is the Money Remittance, Acquirer and account issuer (on process)

3.4 Your rights and your ability to recover your money. By activating your Account, you shall be deemed to have accepted and fully understood the terms and conditions set out in this Agreement and you agree to comply with these by your use of the Card and/or by indicating your acceptance.Your Card is not a credit card and is not issued by a bank. When you purchased your Card, you had the option of an Instant Card, a Virtual Card or a Personalised Card.

3.5 may upgrade for a fee at any time to a Personalised Card. When you upgrade, you will have the option of keeping your Virtual Card account open or closing it and only using your Personalised Card. Regardless of the type of Card(s) you have, you will have only one Account where your Available Balance is located.Your Payment Services will not be activated unless we have been provided with the required information.

3.6. So that we may identify you and can comply with all applicable KYC and antimoney laundering requirements. We shall keep records of such information and documents in accordance with all applicable legal and regulatory requirements.

3.7. You may reload subject to the limits provided by the Fees & Limits Schedule. We reserve the right to vary these limits and to decline any Reload at any time. A Reloading Fee applies.

3.8. Reference to a currency (e.g. Euros € or Sterling £ ) shall mean that amount or the local currency equivalent in which your Card is denominated.

3.9. The Available Balance on your Card and/or Account will not earn any interest. The Payment Services are prepaid payment services and not a credit or bank product, you must therefore ensure that you have a sufficient Available Balance to pay for each purchase, payment or cash withdrawal.

3.10. that you make using the Payment Services (including value added tax and any other taxes, charges and fees that are applicable). If for any reason a Transaction is processed and the Transaction amount exceeds the Available Balance, you must repay us the amount of such excess immediately and we shall be entitled to stop any existing or subsequent Transactions from proceeding.

3.11. This Agreement does not give you any rights against a System, its affiliates or any third party.Only persons over 18 years of age are entitled to register for the Payment Services. However, if you are the Customer you may allow the Payment Services to be accessed by a person for whom you are legally 3.13. responsible who is under 18 years of age in accordance with 5.8. Transactions by persons under 18 years of age may not be allowed by some Merchants. In all cases, you shall be responsible for any use of the Payment Services by such persons.

4. Service Limits

Transactions may be restricted by Card type, individual usage patterns and payment risk profiles. For anti-money laundering and anti-fraud reasons we reserve our rights to change particular payment restrictions (including from those published or included herein) without notice and to the extent required to meet our regulatory obligations.

5. Use of the Services

You can use the Payment Services up to the amount of the Available Balance for Transactions at

5.1. Merchants of the relevant System. If the Available Balance is insufficient to pay for a Transaction, some Merchants will not permit you to combine use of a Card or Account with other payment methods. Your Card (other than the Virtual Card) can be used to make cash withdrawals from ATMs and banks

5.2. who agree to provide this service, as listed in the Fees & Limits Schedule (subject to any maximum set by the relevant ATM operator or bank), unless we inform you otherwise.

5.3. The value of each Transaction and the amount of any fees or charges payable by you under this Agreement will be deducted from the Available Balance.

Once a Transaction is authorised it cannot be withdrawn. Within the EEA we will ensure transfer of the 5.4. payment to the payment service provider of the Merchant within three Business Days, from and including

the 1st January 2012, we will ensure transfer of the payment within one Business Day. If the payment service provider of the Merchant is located outside the EEA, we will effect payment as soon as possible.

5.4. authorisation before processing any Transaction. If a Merchant or ATM operator is unable to get an electronic authorisation, they may not be able to authorise your Transaction. We may refuse to authorise any use of the Payment Services which could breach these terms and

5.5. conditions or if we have reasonable grounds for suspecting that you or a third party have committed or are planning to commit fraud or any other illegal or unpermitted use of the Payment Services.

The Payment Services will incur fees based upon the Fees & Limits Schedule. A Transaction Fee is payable in respect of each Transaction. A Cash Withdrawal Fee is payable in respect of cash withdrawals

5.6. made at ATMs using your Card. In addition, your withdrawal may also be subject to any applicable fees, rules and regulations of the relevant ATM operator or bank. It is your responsibility to check whether any such additional fees apply, as they cannot be refunded once the cash has been withdrawn.

Where applicable, the Customer may apply to us for up to 3 Additional Cards, for use by Additional Cardholders on your account. Additional Cardholders for whom you are legally responsible must be 13 years of age or older. All other Additional Cardholders must be 18 years of age or older.. It is a condition

5.7. of any registration for an Additional Card that you, as the Customer, acknowledge that we accept no responsibility or liability of any kind whatsoever for use of any Additional Card by any Additional Cardholder for Transactions not authorised by you. If you successfully register, we will send you an Additional Card, for which we will charge an Additional Card Fee. Upon receipt of the Additional Card, you may give the Additional Card to the Additional Cardholder for their use, subject to: 1. you providing them with a copy of these terms and conditions (which will then bind use by both of you);

2. the Additional Card then being used only by that person; 3. you retaining the Primary Card;

4. you informing the Additional Cardholder that you have retained the Primary Card and that you are still able to use the Account;

5. Us obtaining such further information and documentation in order to enable us to comply with all applicable KYC and anti-money laundering requirements.

5.8 You (the Customer) will remain responsible for the use of the Payment Services, and for any fees and charges incurred by the Additional Cardholder(s), and you will continue to be regarded as the holder of any funds already or subsequently loaded on the Account. The use of a Card in relation to which an Additional Cardholder has been registered will be regarded as confirmation that you have provided the Additional Cardholder with these Terms and Conditions and they have accepted them. You will remain responsible for any Transactions, cash withdrawals from ATMs, fees and charges incurred by your Additional Cardholders. Your Cards will have a shared purse from which all Transactions and fees will be deducted.

5.9 Your ability to use or access the Payment Services may occasionally be interrupted, for example if we 5.10. need to carry out maintenance on our Schemes. Please contact Customer Services via our website to

notify us of any problems you are experiencing using your Card or Account and we will endeavor to resolve any problem.

5.10. If enabled, you will have the option to transfer your Available Balance from your Card or Account to 5.11. other Cards and Accounts. If you instruct us to make a transfer from your Account to another Account,

the requested amount will be debited from your account and credited to the account you have instructed us to transfer your Available Balance to. You will incur an Account Transfer Fee for this transaction.

6. Condition of Use at Certain Merchants

6.1. In some circumstances we or Merchants may require you to have an Available Balance in excess of the Transaction amount. For example, at restaurants you may be required to have 15% more on your Card than the value of the bill to allow for any gratuity or service charge added by the restaurant or you.

6.2. In some circumstances Merchants may require verification that your Available Balance will cover the transaction amount and initiate a hold on your Available Balance in that amount, examples include rental cars. In the event a Merchant places a pre-authorisation on your Account, you will not have access to these funds until the Transaction is completed or released by the Merchant which may take up to 30 days.

6.3. If you use your Card at a fuelling station, subject to Merchant acceptance, your Card may need to be pre-6.3. authorised for a pre-determined amount in the relevant currency. If you do not use the whole pre-authorisation or do not have Available Balance to obtain a pre-authorisation, it is possible that the preauthorised amount will be held for up to 30 days before becoming available to you again.

6.4. Some Merchants may not accept payment using our Payment Services. It is your responsibility to check the 6.4. policy with each Merchant. We accept no liability if a Merchant refuses to accept payment using our Payment Services.

7. Managing & Protecting Your Account

7.1 You are responsible for your Card, any Username, PIN number and Account passwords. Do not share your Card or Account security details with anyone.

You must keep your Account, PIN, Username and Password safe, and separate from your Card or any record of your Card number and not disclose it to anyone else. This includes:

7.2

1. memorising your PIN as soon as you receive it, and destroying the post mail or other authorised communication used to transmit it to you;

2. never writing your PIN on your Card or on anything you usually keep with your Card; 3. keeping your PIN secret at all times, including by not using your PIN if anyone else is watching;

4. not disclosing your PIN to any person, except that you may disclose the PIN orally (but not in writing) to a person authorised (by clause 5.8) to use your Card or Account.

7.3 The user of the Card(s) must sign the signature strip on any Personalised Card immediately when received. If your Card permits cash withdrawals, we will provide the Customer by post or other approved method with a Personal Identification Number (PIN) for use with your Card. You will need this PIN in order to make cash withdrawals from an ATM or at a bank.

7.4 If you forget your PIN, you should contact Customer Services on 0207 1321100 for a replacement PIN, 7.4. which will be sent out to the Customer. A Pin Replacement Fee will be charged if your PIN has to be re-mailed to you due to failure to keep us notified of your correct primary address. The Customer already held or created a Username and Password when ordering a Primary Card. You will need this Username and Password to perform the following functions in relation to your Payment Services online:

7.5 1. changing your registered details; 2. checking the amount of Available Balance; 3. checking Transaction details; 4. requesting an upgrade or Additional Card (when available); 5. reporting your Card as lost or stolen; 6. changing your Username or Password.

7.6. The Payment Services may only be used by the Customer or any Additional Cardholder.

7.7. Other than as specified in 7.6, you must not give the Card to any other person or allow any other person to use the Payment Services.

7.8. You must keep the Card in a safe place.Failure to comply with clause 7.2 may affect your ability to claim any losses in the event that we can show that you have intentionally failed to keep the information safe or you have acted fraudulently, with undue delay or with gross negligence. In all other circumstances your maximum liability shall be as set out below at clause 14.

7.9. If you believe that someone else knows your Account or Card security details, you should contact us immediately.

7.10. Once any Card on your Account has expired or if it is found after you have reported it as lost or stolen you agree to destroy your Card(s) by cutting them in two through the magnetic strip.

8. Identity Verification

8.1 If you enter into Transactions over the internet, some websites require you to enter your name and address. 8.1. In such cases you should supply the most recent address which has been registered with us by the Customer as the Account address. The Account address is also the address to which we will send any correspondence.

The Customer must notify us within 7 days of any change in the Account address or your other contact details.

8.2 You can notify us by contacting Customer Services who may require you to confirm such notification in writing. You will be liable for any loss that directly results from any failure to notify us of such a change as a result of undue delay, your gross negligence or fraud. We will need to verify your new Account address and shall request the relevant proofs from you.

8.3 We reserve the right at any time to satisfy ourselves as to your identity and home address (for example, by requesting relevant original documents) including for the purposes of preventing fraud and/or money laundering. In addition, at the time of your application or at any time in the future, in connection with your Account, you authorise us to perform electronic identity verification checks directly or using relevant third parties.

9. Communications Regarding Your Account

We will not send you a paper statement unless requested. However, you can check your Available Balance and Transaction history at any time by logging on to your account. The online service is free and you can subscribe to different forms of Account statements there. Should a paper statement be required, this request can be made via our customer service team, there may be a £5 fee per request with postage fee separate.

10. Cancelling Services

10.1. If you are the Customer and you wish to cancel the Payment Services at any time, you must request cancellation online by informing us of your wish to cancel and to claim a refund of your unused funds by

emailing us as specified in section 2 above. You must e-mail us from the e-mail address you provided when registering your Account. Our Customer Services department will then suspend all further use of your Payment Services.

Once we have received all the necessary information from you (including KYC) and all Transactions and applicable fees and charges have been processed, we will refund to the Customer any Available Balance less any fees and charges payable to us, provided that:

10.2. 1. you have not acted fraudulently or with gross negligence or in such a way as to give rise to reasonable suspicion of fraud or gross negligence; and

2. We are not required to withhold your Available Balance by law or regulation, or at the request of the police, a court, or any regulatory authority.

10.3 Once the Payment Services have been cancelled, it will be your responsibility to destroy your Card(s).

If, following reimbursement of your Available Balance, any further Transactions are found to have been

10.4. made or charges or fees incurred using the Card(s) or we receive a reversal of any prior funding transaction, we will notify you of the amount and you must immediately repay to us such amount on demand as a debt.

11. Right to Cancel ("Cooling-Off')

You have a right to withdraw from this Agreement under the following conditions:

where you purchased the Payment Services by mail order, internet, fax, digitally or by email then you have a "Cooling Off" period of 14 days beginning on the date of the successful registration of your Account to withdraw from this Agreement and cancel the Payment Services, without any penalty but subject to deduction of any reasonable costs incurred by us in the performance of any part of the provision of services before you cancel. You must contact us within this 14 day period and inform us that you wish

11.1. to withdraw from this Agreement and you must not use the Payment Services. We will then cancel the Payment Services and reimburse the amount of Available Balance on the Account to the Customer. However, we reserve the right to hold Available Balance for up to 30 business days from receipt of your instructions before returning the balance, to ensure that details of all transactions have been received. If you used a credit or debit card to purchase and/or load your Card or Account, we may hold your funds for a reasonable period as is required to prevent any chargeback of your credit or debit card.

11.2. After the Cooling Off period you may only cancel the Payment Services as described in clause 10 above.

12. Expiry & Redemption

12.1. Your Card has an expiry date printed on it. The funds on your Account will no longer be usable following the expiry date of the most recent Card that was issued under the Account ("Expiry Date").

12.2 The Payment Services and this Agreement shall terminate on the Expiry Date unless you request or are 12.2. issued with a replacement Card prior to the Expiry Date in accordance with clause 12.4 or unless we otherwise agree to continue providing Payment Services to you following the Expiry Date.

12.3. You may not use your expired Card(s) after the Expiry Date.If a Card expires before your Available Balance is exhausted, you can contact Customer Services to

12.4. request a replacement Card, provided you do so 14 days before the Expiry Date and subject to payment of a fee (where specified).

12.5. Notwithstanding any Expiry Date your funds are available for redemption by contacting us at any time before the end of the 6 years Limitation Period. After the 6 years Limitation Period your funds will no longer be redeemable to you. Provided that your request for redemption is made less than 12 months following the Expiry Date

12.6. redemption will not incur any Late Redemption Fee. In the event that you make a request for redemption more than 12 months after the Expiry Date and before termination of the contract an Account Closure Fee may be charged (where specified).

12.7. Additional Cardholders' Cards will expire on the Expiry Date as shown on the Customer's Primary Card.

12.8. We reserve the right to issue you with a replacement for an expired Card even if you have not requested 12.8. one. If we do so, clause 12.4 will not apply. If you have not requested a replacement Card, you will not be charged a Card Replacement Fee as set out in the Fees & Limits Schedule.

We shall have the absolute right to set-off, transfer, or apply sums held in the Account(s) or Cards in or 12.9.

12.9. towards satisfaction of all or any liabilities and fees owed to us that have not been paid or satisfied when due.

13. Termination or Suspension of Your Account

13.1. We may terminate your use of the Payment Services with prior notice of at least 2 months.

13.2. Your12.2/ use of the Payment Services will be terminated following the Expiry Date in accordance with clause

We may terminate or suspend, for such period as may reasonably be required, your use of the Payment Services at any time, without prior notice:

1. in the event of any fault or failure in the data information processing system; 2. if we reasonably believe that you have used or are likely to use the Payment Services, or allow 13.3. them to be used, in breach of this Agreement or to commit an offence; 3. if any Available Balance may be at risk of fraud or misuse; 4. if we suspect that you have provided false or misleading information; 5. By order or recommendation of the police or any relevant governmental or regulatory authority.

13.3. If any Transactions are found to have been made or charges or fees incurred using your Card after any action has been taken by us under clause 13.1, the Customer must immediately repay such amounts to us.

14. Lost or Theft of your Card

14.1. You are responsible for protecting your funds as if they were cash. You should treat your funds like cash in your wallet and look after it accordingly.

14.2 If you lose your card or 14.2. it is stolen you may not be able to recover the funds on your account in just the same way as you would usually not be able to recover cash which you lose or which is stolen from you.

If your Card is lost or stolen or if you think someone is using the Payment Services without your permission or if your Card is damaged or malfunctions:

14.3.

1. you must contact us as soon as possible and you must provide us with your Account or Card number and either your Username and Password or some other identifying details acceptable to us so that we can be sure we are speaking to you; and

2. Provided we have obtained the Customer's consent to close the Account, we will then provide the Cardholder with a replacement Card with a corresponding new Account loaded with an amount equivalent to your last Available Balance.

14.4. You will be liable up to a maximum of the first £50 of losses arising from any unauthorised Transactions that take place prior to your notifying us of the loss or theft. If our investigations show that any disputed 14.4. transaction was authorised by you, or you have acted fraudulently or with gross negligence (for example

by failing to keep your Prepaid Card or PIN secure), we may reverse any refund made and you may be liable for any loss we suffer because of the use of the Prepaid Card. We may also charge you the

Investigation Fee specified in the Fee Schedule. You will not be held liable for any losses once you have notified us of loss or theft unless we reasonably determine that you have acted in accordance with clause 16.1.ii.f.2 - in which case you shall be liable for all losses.

14.5. Once we have been notified of any loss or theft, we will suspend the Payment Services as soon as we are able, to limit any further losses. We can only take steps to prevent unauthorised use of the Payment

Services if you can provide us with the Account or Card number and Username and Password or if you can produce sufficient details to identify yourself and the relevant Account.

14.6. Replacement Cards will be posted to the most recent Account address registered by the Cardholder. Failure to provide the correct address will result in a Card Replacement Fee.

14.7. If you subsequently find or retrieve a Card that you have reported lost or stolen, you must immediately destroy the found Card by cutting it in half through the magnetic stripe.

14.8. You agree to help us, our agents, regulatory authorities and the police if your Card is lost, stolen or if we suspect that the Payment Services are being misused.

15. Fees & Foreign Exchange

15.1 The Payment Services will incur fees and charges as set out in the Fees & Limits Schedule for which you 15.1. shall be responsible. These vary depending on the products you use and from time to time in accordance with that Schedule

15.2 We will deduct any value added tax, and other taxes, charges and fees due by you to us from the available Balance. If there is no Available Balance, or value added tax and other taxes, charges and fees incurred exceed the Available Balance, you must pay us the excess immediately.

15.3 If you use the Payment Services in a currency other than the currency in which the Payment Services are denominated, the amount deducted from your Available Balance will be the amount of the Transaction converted to your Account currency using a rate set by the System on the date the Transaction is processed which rate may be applied without notice. Please refer to the MasterCard website for more information. You may also be charged a Foreign Exchange Charge as set out in the Fees & Forex price schedule.

16. Our Liability

Subject to clauses ii.f and 14.4;;

1. neither party shall be liable to the other for indirect or consequential loss or damage (including without limitation loss of business, profits or revenues), incurred in connection with this Agreement, whether arising in contract, tort (including negligence), breach of statutory duty or otherwise;

2. we shall not be liable:

1. if you are unable to use the Payment Services as set out or for any reason stated in clauses 4 and 10; 2. for any fault or failure beyond our reasonable control relating to the use of the Payment Services, including but not limited to, a lack of Available Balance or fault in or failure of 16.1. data processing Schemes; 3. if a Merchant refuses to accept a Transaction or fails to cancel an authorisation or pre-authorisation; 4. for the goods or services that are purchased with your Card; 5. for any loss, fraud or theft that is reported more than 8 weeks following the event; 6. where you or an Additional Cardholder acted with: 16.1.ii.f.1. undue delay

16.1. ii.f.2. fraudulently; or

16.1. ii.f.3. With gross negligence. (including where losses arise due to your failure to keep us notified of your correct personal details)

16.2. To the fullest extent permitted by relevant law, and subject to clause 14.4, our total liability under or arising from this Agreement shall be limited as follows:

1. where your Card is faulty due to our default, our liability shall be limited to replacement of the Card or, at our choice, repayment to you of the Available Balance;

2. where sums are incorrectly deducted from your Available Balance due to our fault, our liability shall be limited to payment to you of an equivalent amount; and

3. In all other circumstances of our default, our liability will be limited to repayment of the amount of the Available Balance.

16.3. Nothing in this Agreement shall exclude or limit either Party's liability in respect of death or personal injury arising from that party's negligence or fraudulent misrepresentation.

16.4 No party shall be liable for, or be considered in breach of this Agreement on account of, any delay or

16.4. failure to perform as required by this Agreement as a result of any causes or conditions which are beyond such Party's reasonable control and which such Party is unable to overcome by the exercise of reasonable diligence.

17. Refunds for Transactions

17.1. A Transaction shall be considered to be unauthorised if you have not given your consent for the transaction to be made. If you believe that a Transaction has been made without your consent you should contact us in accordance with clause 2.

17.2 A claim for a refund of an authorised Transaction must be made within 8 weeks from the date on which 17.2. the funds were deducted from your Available Balance. Within 10 Business Days of receiving your claim for a refund we will either refund the full amount of the Transaction or provide you with justification for refusing the refund.

17.3. If you are not satisfied with the justification provided for refusing the refund or with the outcome of your 17.3. claim for a refund, you may submit a complaint to us or contact the complaints authority as described in clause 18.

17.4. We may charge fees in connection with any of our services and facilities that you have made use of or requested based on our Schedule of Fees.

17.5. Where any request, transaction, disputed transaction, arbitration or reversed transaction involves third 17.5. party costs you remain liable for these and they will be deducted from your account or otherwise charged to you.

17.6. We may charge you an Administration Fee in the following circumstances:

1. in the event that you make any payment to us that is subsequently reversed after 60 days due to inadequate account information or inadequate KYC documentation; 2. in the event of a request for arbitration of a disputed Transaction; 3. To cover our costs and expenses in providing you with manual support on your account (e.g. a request for legal, police, court or other judicial support).

17.7. We may charge you a Reverse Payment Charge where a receiving bank declines receipt of a payment following a request to transfer your funds

18. Payment Disputes

18.1. We aim to provide customers with easy access to our customer services team who receive record, investigate and respond to complaints.

18.2. We take complaints very seriously and value the opportunity they provide to assist us with reviewing the 18.2. way we do business and helping us meet our customers' expectations. Our primary aim is to resolve any

complaints that you may have as quickly and effectively as we can and consequently have documented the steps to be taken below.

18.3. In the first instance, your initial communication will be with our Customer Care Team. We expect our Customer Care Team to respond to your complaint within five working days. If having received a response from our Customer Care Team you are unhappy with the outcome, please

18.4. contact the Complaints Officer of A&B General (UK) Limited 2nd Floor Greenwich Quay Clarence Road London SE8 3EY UK directly in writing via email on This email address is being protected from spambots. You need JavaScript enabled to view it..

18.5. If the Complaints Officer is unable to respond to your complaint immediately, you will receive confirmation that your complaint has been received and a formal investigation will be conducted. It is anticipated that you will receive a formal response of their findings within four weeks.

18.6 If the Complaints Officer of A&B General Ltd is unable to resolve your complaint and you 18.6. wish to escalate your complaint further, please contact the Financial Ombudsman Service at South Key Plaza, 183 Marsh Wall, London, E14 9SR. Details of the service offered by the Financial Ombudsman Service are available at www.financialombudsman.org.uk

18.7. You must provide us with all receipts and information that are relevant to your claim.

18.8. If our investigation shows that we have incorrectly deducted money from your Available Balance, we 18.8. shall refund the amount to you. If we subsequently establish that the refunded amount had been correctly

deducted, we may deduct it from your Available Balance and may charge you an Investigation Fee. If you do not have sufficient Available Balance, you must repay us the amount immediately on demand.

In relation to any dispute between the Cardholder and a Merchant, provided you are able to satisfy us that you have already made all efforts to resolve the dispute with the relevant Merchant, we will attempt to assist you so far as is reasonably practicable. We may charge you a Chargeback Processing fee as

18.9. referenced in the Fees & Limits Schedule for any such assistance we may give you with any such dispute. If there is an un-resolvable dispute with a Merchant in circumstances where the Card has been used for a Transaction, you will be liable for the Transaction and will have to resolve this directly with the relevant Merchant.

19. Personal Data

19.1. We are the data controller for your personal data and will process personal data given to us in connection 19.1. with your Account in order to administer your Account and provide you with services relating to the account and this Agreement. We may also use your personal data for marketing purposes and for market research purposes, in accordance with applicable legislation and our Privacy Policy.

19.2. We may check your personal data with other organisations, and obtain further information about you in order to verify your identity and comply with applicable money laundering and governmental regulations. A record of our enquiries will be left on your file. In accordance with our Privacy Policy and applicable legislation, we may provide personal data supplied by you to certain named third parties (including data processors) for the purpose of performing our obligations and exercising our rights under this Agreement, including third parties located outside the European Union where different data protection standards may apply.

19.3. We may also disclose your personal data as required by law or any competent authority. By agreeing to these terms and conditions, you acknowledge and agree to our processing of your personal data in this way.

19.4. You have the right to receive certain information concerning the personal data we hold about you (for which you may be charged a fee), and to rectify such data where it is inaccurate or incomplete.

19.5. You have also seen our Privacy Policy document and acknowledge and agree to the provisions thereof (as amended from time to time).

19.6. If you have elected to opt in to receive email and SMS marketing, we may share your information with third parties so they can contact you directly by telephone or email about their products and services.

20. Changes to the Terms and Conditions

We may update or amend these terms and conditions (including our Fees & Limits Schedule). Notice of any changes will be given on the website or by notification by e-mail or by means of mobile device at least 2 months in advance. By continuing to use the Payment Services after the expiry of the 2 month notice period after the expiry of the 2 month notice period you acknowledge that you indicate your acceptance to be bound by the updated or amended terms and conditions. If you do not wish to be bound by them, you should stop using the Payment Services immediately in accordance with our cancellation policy (see clause 10).

21. Miscellaneous

21.1. We may assign our rights, interest or obligations under this Agreement to any third party (including by 21.1. way of merger, consolidation or the acquisition of all or substantially all of our business and assets relating to the Agreement) upon 2 month's written notice. This will not adversely affect your rights or obligations under this Agreement.

21.2. We do not intend that any of the terms of this Agreement will be enforceable by a person not a party to it, except that Schemes and their affiliates may enforce any right granted to it under this Agreement.

21.3. Any waiver or concession we may allow you will not affect our strict rights and your obligations under this Agreement.

21.4. The Customer and any Additional Cardholders agree that they will not use the Payment Services in an 21.4. illegal manner and you agree to indemnify us against any claim or proceeding brought about by such illegal use of the Payment Services.

21.5. This Agreement and the documents referred to in it, constitute the entire agreement and understanding of 21.5. the parties and supersede any previous agreement between the parties relating to the subject matter of this Agreement.

22. Funds Protection

Your funds are safeguarded by law. In the event that A&B General became insolvent your e-money funds are protected against claims made by any other creditors.

23. Regulation & Law

23.1. The Payment Services, Card and Account are payment products and not deposit, credit or banking products, as such they are not covered by the Financial Services Compensation Scheme.

To the fullest extent permitted by law and without affecting your legal rights as a consumer, this Agreement and any dispute or claim arising out of or in connection with it or its subject matter or

23.2. formation (including non-contractual disputes or claims) shall be governed by, and construed in accordance with, the laws of England & Wales and the courts of England & Wales shall have exclusive jurisdiction in relation to the same.

IT Security Awareness for Customers

Awareness and Knowledge for Online Banking Services:

Cybercriminal attacks on individuals most of the time so it is important to be aware of the threats and to approach anything on the internet that involves customer identity or account numbers with caution. Cyber criminals have several ways to steal identity such as creating fake websites that mimic legitimate sites such as PayPal or Some Banking Website to steal confidential information.

In some case, theft and fraud is committed by family members and friends or acquaintances of victims who, because of these relationships, have relatively easy access to account numbers and passwords saved on computers.

Security Practices list

-

Verify use of a secure session (https:// and not http://) when entering passwords on the internet.

-

Pay attention to the URL (web address) that you are visiting! Fraudulent websites often create misleading web address like https://www.somecompany.AnotherWebsite.com/ to trick users of a https://www.somecompany.com/ into believing they are visiting a legitimate site where they have an account when they are really at a password harvesting spoof of the legitimate website. This is a quite common trick that scammers use to fool users for steal passwords by fake copies of real websites

-

No website or service will ever lose a user’s login information and request that the user provide it to the website or company. Requests involving this sort of statement are always a scam and usually involve some sort of coercive statement such as threatening the loss of funds if login credentials are not supplied in time.

-

Avoid saving passwords to any computer.

-

Always use Log Out buttons when you are finished to end your secure sessions. This helps prevent session hijacking attacks where hackers keep sessions open when you think they have been closed.

-

Never leave computers unattended when using online banking services.

-

Never access sensitive computer systems or websites from public computers at a hotel, library, coffee shop or when using your own devices over any public wireless access point.

-

Offers for employment as a mystery shopper, payment processor, etc. where you are required to use your personal account for someone else’s business purposes are never legitimate.

-

No legitimate business will attempt to move business funds through anyone’s personal account.

Password Security:

It is difficult to the system to check that user who have the correct password is the truly account holder so it mostly important that customer must keep their passwords private and immediately report any suspected security violations. Below is a list of some common password choices and bad behavior to avoid:

-

Your name, or a family member or pet’s name

-

Social Security, account, or telephone numbers

-

Solitary word in any language. Hackers have dictionary-based systems to crack these types of passwords

-

Any part of your physical address

-

Anybody’s birth date

-

Other information that is easily obtained about the user

-

A word in the English or any foreign dictionary, even spelled backwards

-

A password used on another site

-

Sequences: “12345678”, or “33333333”, “abcdefgh”

-

Write your passwords down, share them with anyone or let anyone see you log into devices or websites.

-

Answer "yes" when prompted to save your password to a particular computer's browser.

The password choices and good behavior to do:

-

Use a combination of uppercase and lowercase letters, symbols, and numbers.

-

Make sure your user passwords are at least eight characters long. The more characters and symbols your passwords contain, the more difficult they are to guess.

-

Change your passwords regularly.

-

Log out of websites and devices when you are finished using them.

Aware of Cyber threats:

If customer know what kind of cyber threats they might face these days, then they can avoid and protect themselves better. The list of threats and how to handle show as below

Common spam email security threats:

Spam emails are annoying enough, but some of them can put your digital safety at risk. Some spam messages contain viruses, malware, and other cyberthreats. Here are a few to watch for.

Trojan horses

Trojan horses come disguised as a legitimate program. Even if the customer think they know how to verify whether an email is legitimate, a trojan horse uses deception to get past those defense mechanisms.

For instance, It can hide inside free software downloads or arrive as an email attachment, possibly from someone you know.

When open the email, the trojan installs malicious code — typically spyware or viruses — designed to create problems on their computer.

It may allow an attacker to control the computer, lock you out, steal the data, account information or email addresses. Installing anti-malware software may help you catch these trojans.

To help avoid trojan horses, avoid clicking on pop-up messages on the computer. If you are seeing a lot of pop-ups, consider running an antivirus scan.

Zombies

Zombies are a type of malware that also comes in email attachments. They turn the computer into a server and sends spam to other computers. Customer may not know that their computer is compromised, but it may slow down considerably, or the battery may drain quickly. Meanwhile, the computer may be sending out waves of spam or attacking web pages.

One way to avoid zombies is to avoid opening attachments or clicking links in emails from the spam folder.

Lottery scams and fake offers

Sometimes, cyber thieves use old-school scams that might seem legitimate but are fake offers. These play on customer desires or good nature: You've won a lot of money or someone urgently needs your help.

The customer has not won a lottery or a cruise around the world. And they have not been selected by a foreign prince to receive $10 million, in exchange for the use of their bank account number. Look for phrases of urgency like, “Immediate,” and “Act Now” in the email’s title to avoid lottery scams and fake offers. Refer to the Delete Emails section of this post for additional characteristics to look for.

How to stay spam free:

So far, there is no such thing as a "do not email" list for spam. Until there is, Customer will have to take care of spam themselves.

Fortunately, there are good tools to help you do that. Most email programs include spam filters that can help detect and isolate spam. Many internet service providers filter out spam, so it never reaches your computer. But it is wise to install and run anti-virus security software that can eliminate viruses that may already live on the computer.

Spam emails, otherwise known as junk mail, are uninvited bulk-sent email messages delivered to an inbox. You probably receive email spam and marketing messages regularly. But there is one difference between a spam message and marketing message: permission.

Spam messages often come from illegitimate email addresses and may contain explicit or illegal content. These emails often use scare tactics, contain typos and misleading information, and are sent in bulk from an anonymous sender. They seldom contain an unsubscribe link, and if it does, that link may be embedded with malware. This could lead to cybercriminals gaining access to your computer, smartphone, and other devices.

There are ways to help slow the tide of unwanted emails. So, here are the few simple ways you can take to help eliminate spam emails.

1. Mark as spam

Most email services, such as Gmail, Yahoo Mail, Microsoft Outlook, and Apple Mail have algorithms that filter out spam and junk mail by tucking them away in a folder.

But if customer find a spam email in their regular inbox, don't delete the message — mark it as spam. Marking a suspicious email as spam will send it to the spam folder. Moving forward, if you receive any more emails from this address, the spam filter will know no to let it into your inbox.

2. Delete spam emails

There is a golden rule to dealing with spam emails: if it looks like a spam message, it probably is — so delete it without clicking or downloading anything. If the message in question appears to come from someone you know, contact them outside of your email.

3. Keep your email address private

Giving out your email address can increase the amount of spam email you receive. So, if it’s not essential to share, keep it private. Also, consider changing your email privacy settings.

4. Unsubscribe from email lists

Unsubscribing from email lists is an ideal way to keep out from spam email. Marketers often get the customer email address from online forms, social media, and scraping tools, and purchase customer information from other companies. So, the less they subscribe to, the less these marketers and spammers can find your address.

Common Phishing threats:

Phishing is a cybercrime in which scammers try to lure sensitive information or data from you, by disguising themselves as a trustworthy source. Phishers use multiple platforms.

How does phishing work?

-

The phisher begins by determining who their targeted victims will be (whether at an organization or individual level) and creates strategies to collect data they can use to attack.

-

Next, the phisher will create methods like fake emails or phony web pages to send messagesthat lure data from their victims.

-

Phishers then send messages that appear trustworthyto the victims and begin the attack.

-

Once the attack has been deployed, phishers will monitor and collect the datathat victims provide on the fake web pages.

-

Finally, phishers use the collected data to make illegal purchases or commit fraudulent acts.

Types of phishing attacks

1. Email Phishing

The basic phishing email is sent by fraudsters impersonating legitimate companies, often banks or credit card providers. These emails are designed to trick you into providing log-in information or financial information, such as credit card numbers or Social Security numbers.

Other spoof emails might try to trick the customer into clicking a link that leads to a fake website designed to look like Amazon, eBay, or bank. These fake websites can then install malware or other viruses directly onto the computer, allowing hackers to steal personal information or take control of the computer, tablet, or smartphone.

How to recognize phishing emails

Scammers have become more sophisticated when it comes to sending out phishing emails. But there are still some signs the customer can look for:

-

Too good to be true offers.Phishing emails may try to hook you with what appears to be incredibly cheap offers for things like smartphones or vacations. The offers may look irresistible but resist them. They are likely phishing emails.

-

A bank — maybe not even your own — is asking for your account information or other personal financial information.Your bank, or any financial institution, will never ask for your Social Security number, bank account number, or PIN by email. Never provide this information in response to an email.

-

Spelling and grammatical mistakes.There was a time when you could easily spot phishing emails because they were littered with spelling and grammar mistakes. Scammers have gotten better at avoiding these errors, but if you do receive an email littered with typos and weird language, that email might be sent from someone phishing.

-

The generic greeting.Phishing emails might not be addressed specifically to you. Instead, the email might start with a generic greeting such as “Dear Sir or Madam” or “Dear Account Holder.”

-

A call for immediate action.Phishers want you to act quickly, without thinking. That is why many will send emails asking you to immediately click on a link or send account information to avoid having your bank account or credit card suspended. Never reply hastily to an emergency request. Urgent requests for action are often phishing scams.

-

Senders you do not recognize.If you do not recognize the sender of an email, consider deleting it. If you do decide to read it, be careful not to click on links or download files.

-

Senders you think you recognize.You might get a phishing email from a name you recognize. But here is the catch: That email may have come from the compromised email account of someone you know. If the email requests personal information or money, it is likely it’s a phishing email.

-

If you receive an email that requests you click on an unknown hyperlink, hovering over the option might show you that the link is really taking you to a fake, misspelled domain. This link is created to look legitimate but is likely a phishing scam.

-

The sender included attachments that do not make sense or appear spammy.

2.Pop-up phishing

Pop-up phishing is a scam in which pop-up ads trick users into installing malware on their computers or convince them to purchase antivirus protection they do not need.

These pop-up ads sometimes use scare tactics. A common pop-up phishing example is when an ad might pop up on a user’s screen warning the user that their computer has been infected and the only way to remove the virus is by installing a particular type of antivirus software.

Once the user installs this software, it either does not work or, worse, does infect the computer with malware.

How can I protect myself from phishing attempts?

Though hackers are constantly coming up with new phishing techniques, there is good news. There are some things that customer can do to protect themselves and their organization. All it requires is some common sense.

-

Do not open suspicious emails.If customer receive an email supposedly from a financial institution with an alarming subject line — such as “Account suspended!” or “Funds on hold” — delete it. If the customer is worried that there is a problem, log in to the account or contact the bank directly. If there really is a problem with the bank account or credit card, they can find information once they have logged in.

-

Do not click on suspicious links in emails.If the customer does open an email from someone they do not know and instructed to click on a link, do not. Often, these links will take you to fake websites that will then encourage them to either provide personal information or to click on links that might install malware on your computer.

-

Do not send financial information through email.their bank or credit card provider will never ask them to provide bank account numbers, Social Security number, or passwords through email.

-

Do not click on pop-up ads.Hackers can add fraudulent messages that pop up when visit even legitimate websites. Often, the pop-ups will warn the customer that their computer is infected and instruct them to call a phone number or install antivirus protection. Avoid this temptation. Scammers use these ads to either install malware on the computer or scam out for payment for a computer clean-up they do not need.

-

Use spam filters.Spam filters can help block emails from illegitimate sources, but the customer should always use best judgment in case phishing emails get past your blocker.

-

Sign up for antivirus protection.Make sure the computer is protected by strong, multi-layered security software.

Installing and running trusted security software may provide real-time threat protection, help them create and manage unique passwords, and help protect personal files and financial information from phishing attacks and other scams.

How to recover after responding to a phishing email

-

Change your passwords:Make sure to change the passwords they use for their banking, credit card and other accounts. Use a combination of numbers, letters, and symbols to make these passwords more difficult to crack. Consider enabling multi-factor authentication if it is available. Multi-factor authentication requires entering a second piece of information — such as a code sent to your smartphone — to access an account.

-

Contact your credit card providers:If the customer has given up credit card information, immediately call the credit card providers. They can freeze the account credit to prevent unauthorized purchases. They can also work with customer to determine which purchases on the accounts are legitimate and which were made by criminals.

-

Check your credit reports:Order free copies of the customer credit reports from Credit Report provider. Check these reports carefully for any unfamiliar activity to make sure no one has opened credit card accounts or loans in the customer’s name.

-

Study your credit card statements:Be on the lookout for any unauthorized or suspicious charges.

Remote monitoring

and

Management IT Resources

Manage the several Computers in organization can be hard work and really need a lot of time to make sure any IT asset have firmware and software up to date. Remote monitoring and management IT Resources Tool will be the one point of control that improve security and reduce risk in the organization in several way:

-

Reliability and Productivity To make all the IT assets managed and maintained from one point in real time for ensure all uptime and performance. Reduce the IT support time and associated cost.

-

Reduce Risk To detect and repair problems which is reduce overall downtime and security risk.

-

Enhance IT Security To make sure all the IT assets have regular updates on operation systems and have all vulnerabilities patched.

Scope:

All of officer’s computer will be install the client software of Remote monitor and management tool. The software will monitor all the machine and network usage activity to the main Account that hold by authorized person and regular update patch to the system. Authorized persons have ability to control and remote to client computer for purpose of solve the technical issues.

Remote monitoring and Management Use

1.Monitor IT assets

All the computer in the organization will be monitor on the system, performance, resources and process, uptime logged in user and network usage in real-time. Management software will be installed on authorized control person’s smartphone to help and control from anywhere any time. Any critical IT system issue will be alert directly to authorized control person.

2.Automate Task

Support automate task under the policy IT resources usage such as automate backup specific folder or automate notification to authorized control person when system triggered.

3.Routine update and patch

Routine make as twice a week to check and install update to operation system and software. Vulnerabilities patch update and antivirus scan task run as daily. Authorized person can take control the update process or start the process instantly.

4.Control and Remote

Authorized control person can remote to client computer to control or operate under the purpose of work or solve the technical issues. Chat and file sharing feature support work remote. Authorized control person allows to control and command such as Restart the machine or Shutdown the computer by use the main software or App.

5. Report

Report summary usage of all IT assets in organization to know the overall and detail that help the organization to plan and mange the resources the report will be cover as list

-

Summary monitor and resource report.

-

Any issue or critical error report in the last 30 days.

-

Patch and update log and track.

-

Network usage report.

| Sanction Country | Country code | Prohibited Country | Country code | High Risk +EDD | Country code | High Risk country | Country code | |||

| Afghanistan | AF | Belarus | BY | Nigeria | NG | Algeria | DZ | |||

| Crimea | N/A | Central African Rep | CF | Puerto Rico | PR | Angola | AO | |||

| Cuba | CU | Congo, the Democratic Republic | CD | Saudi Arabia | SA | Antigua and Barbuda | AG | |||

| Iran, Islamic Republic of | IR | Eritrea | ER | Sri Lanka | LK | Armenia | AM | |||

| North Korea | KP | Ethiopia | ET | Tunisia | TN | Azerbaijan | AZ | |||

| Syria | SY | Republic of Guinea | GN | Belize | BZ | |||||

| Venezuela | VE | Iraq | IQ | Benin | BJ | |||||

| Lebanon | LB | Bolivia | BO | |||||||

| Liberia | LR | Bosnia-Herzegovina | BA | |||||||

| Libya | LY | Brazil | BR | |||||||

| Mali | ML | British Virgin Islands | VG | |||||||

| Myanmar | MM | Burundi | BI | |||||||

| Pakistan | PK | Cape Verde | CV | |||||||

| Russian Federation | RU | China | CN | |||||||

| Somalia | SO | Colombia | CO | |||||||

| South Sudan | SS | Comoros | KM | |||||||

| Sudan | SD | Curacao | CW | |||||||

| Ukraine | UA | Dominica | DM | |||||||

| Yemen | YE | Dominican Republic | DO | |||||||

| Zimbabwe | ZW | Ecuador | EC | |||||||

| Bahamas | VS | Egypt | EG | |||||||

| Botswana | BW | El Salvador | SV | |||||||

| Ghana | GH | Gaza Strip | PS | |||||||

| Panama | PA | Guatemala | GT | |||||||

| Barbados | BB | Guinea Bissau | GW | |||||||

| Cambodia | KH | Haiti | HT | |||||||

| Iceland | IS | Honduras | HN | |||||||

| Jamaica | JM | India | IN | |||||||

| Mongolia | MN | Kazakhstan | KZ | |||||||

| Nicaragua | NI | Kenya | KE | |||||||

| Uganda | UG | Kosovo | XK | |||||||

| Albania | AL | Kyrgyzstan | KG | |||||||

| Mauritius | MU | Lao People's Democratic Republic | LA | |||||||

| Guam | GU | Mexico | MX | |||||||

| American Samoa | AS | Moldova | MD | |||||||

| Samoa | WS | Montenegro | ME | |||||||

| Trinidad & Tobago | TT | Morocco | MA | |||||||

| United States Virgin Islands | VI | Mozambique | MZ | |||||||

| Cayman Islands | KY | Paraguay | PY | |||||||

| Palau | PW | Philippines | PH | |||||||

| Vanuatu | VU | Serbia | RS | |||||||

| Seychelles | SC | Sierra Leone | SL | |||||||

| Fiji | FJ | St Kitts & Nevis | KN | |||||||

| Oman | OM | St Lucia | LC | |||||||

| St Maarten | SX | |||||||||

| St Vincent & Gren | VC | |||||||||

| Tajikistan | TJ | |||||||||

| Tanzania | TZ | |||||||||

| Thailand | TH | |||||||||

| Turkey | TR | |||||||||

| Turkmenistan | TM | |||||||||

| Uzbekistan | UZ | |||||||||

| Vietnam | VN | |||||||||

| West Bank (Palestinian Territory) | PS | |||||||||

| Western Sahara | EH |

| Risk Level | Trading Address | Registration Address | Residency Address | Owner/Director Residency | Send/Receive Money | EDD on All Payments |

| High + EDD | Yes | Yes | Yes | Yes | Yes | Yes |

| Prohibited | No | No | No | Yes | No | No |

| Sanctioned | No | No | No | No | No | No |

Version Control

Version Date Version Issued Brief Summary of Change

21/05/2020 V1.0 Document created

Document classifications: EXTERNAL © 2020 A&B GENERAL (UK) LIMITED

Customer Acceptance Policy

Version History

| Version | Changes | Author | Board approval date |

| 1.0 | Original document | Chakree Chankana | 1 Sep 2019 |

| 2.0 | Original document | Chakree Chankana | 9 Nov 2020 |

Policy Review

This policy (the “Policy”) is reviewed annually by the board of directors.

Customer On-Boarding Requirements

Who is the Customer?

The customer (the “Customer”) is the entity with whom the Company intends to hold a contract for the provision of consulting services.

Generally, this will be a limited company or a limited liability partnership. In certain cases, this may be a private individual.

The Customer

Key Business Details

As a minimum, the Company shall collect all information as required by the Company’s AML/CTF policies and procedures.

Customer Sign-Off

A new Customer’s file must be reviewed and sign-off by a member of the Company’s compliance team. Where the compliance team member is not

satisfied with the details provided, notwithstanding the automatic rejection criteria below, they shall undertake additional due diligence

on the Customer.

Rejection Criteria

The Customer will be rejected automatically in the following situations:

• Customer is listed on an international sanctions list (e.g. OFAC)

• Any individual connected with the Customer is identified as a PEP

• Any individual connected with the Customer is listed on an international sanctions list (e.g. OFAC)

• Customer or any individual/legal entity associated or any other with the Customer is engaged in any of the prohibited activities listed in Schedule 1

• Customer is based in a jurisdiction with a high risk of money laundering

Schedule 1: Prohibited Industries

• Adult entertainment including dating and escort services

• Agencies recruiting foreign workers in the UK

• Binary options trading

• Bitcoin/digital currency issuers Bonded warehouses

• Crowd funding

• Debt management and collection Defence

• Development aid

• Diamond and precious metal merchants, including jewellers Embassies

• Energy

• File sharing

• Gambling

• Investments

• Life science and experimental companies

• Mining companies involved in exploration and extraction

• Non-UK registered companies

• Nutrition and pharmaceuticals

• Online forex trading, including managed forex accounts

• Pay day lenders

• Political parties, pressure groups and think tanks

• Private security firms

• Unregistered charities (i.e. not registered with the Charity Commission)

• Offshore bank transactions/ Shell banks

• Remittances funded in cash; Cash and Check Handling: Check Cashing, Deposit Taking, Cash Transfer.

• Companies formed of Bearer Shares

• Shell companies

• Fourth party payment & multi-layered MSB arrangements

• Transactions for goods subject to export prohibition/restrictions

• Transactions with living animals (exceptions possible like for payments for horse riding, or dog classes)

• Political / religious organisations engaged in hate speech

• Sanctioned entities

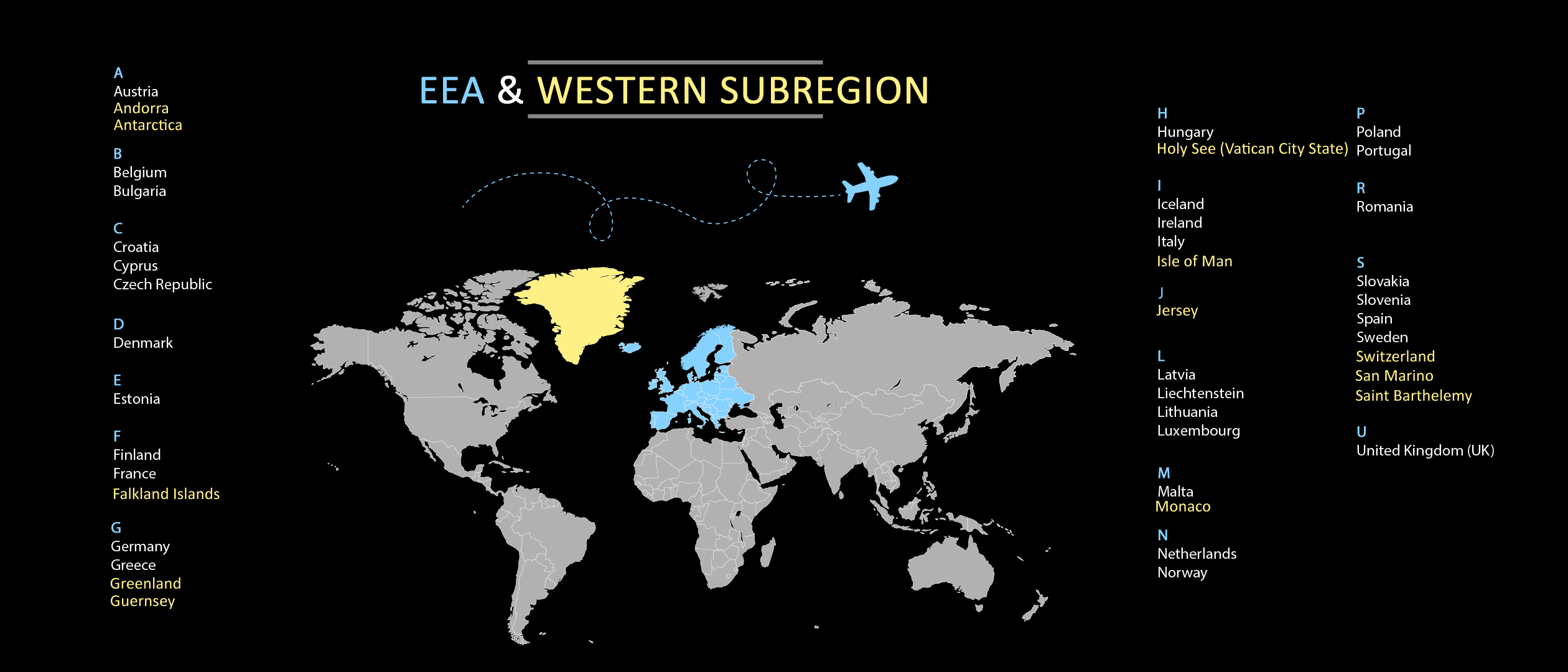

You can open account with us. If you have a passport or driving licence and proof of address documents in UK. We cannot open an account with a temporary resident visa. (EEA and Western Subregion countries is soon available)

Opening account with us is not related to any credit score, which is suitable for a student visa with no financial history. There are no obstacles to opening account with us with guaranteed approval, however the cardholder may be turned down if information cannot be verified. You have experienced with the bank suspension and ask to close your bank account. But we are friendlier to treat you to open an account with us.

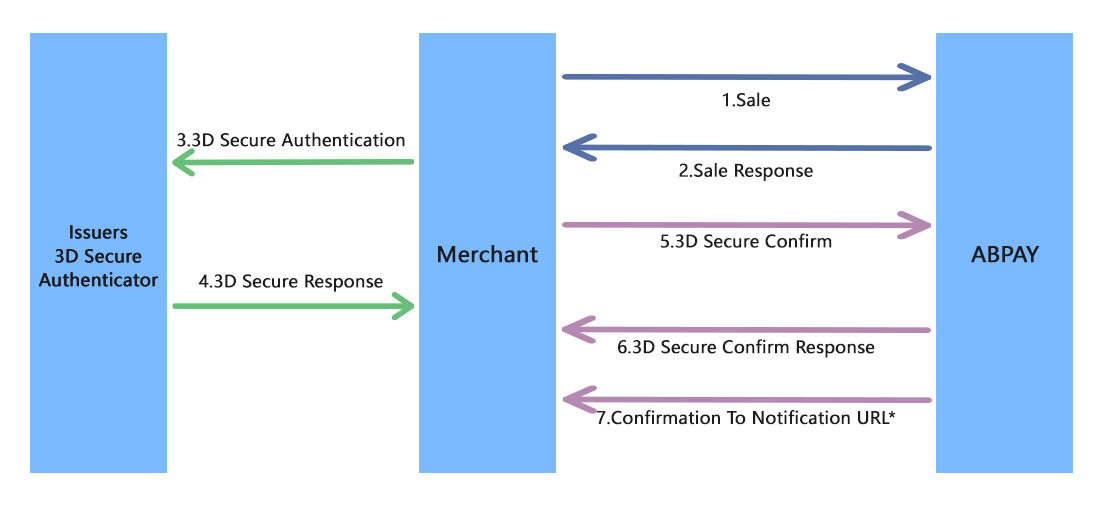

Before reading this section, please ensure you have read our 3D Secure documentation, this section explains what is required and lists each step in great depth to allow merchants to fully understand how to successfully integrate using 3D Secure.

The 3D Secure Confirm API is required to ensure the consumer has passed authentication. You must make the 3D Secure Confirm request inside your TermURL as this is where the consumer will be redirected after they input their unique secure code. When redirecting, 3D Secure will POST the PaRes to your TermURL where you must obtain and supply this value for the PaRes field of the 3D Secure Confirm request. The PARes is the reply received from the Issuing Bank after the card holder has been authenticated. The merchant must then provide the Transaction Code they generated when making the sale request and supply this value for the transactionCode field.

Making The Request

HTTP is used as the request-response protocol between a merchants site and the ABPAY API. In the back end, a merchant submits a HTTP POST request to the ABPAY server, the server will then return an JSON document where the merchant must parse the data inside and act accordingly. The response contains key information about the request and also contains the requested content.

The request string that is sent for the `3D Secure Confirm` call must be composed of the following information:

1. username = SomeName

2. password = SomePassword

3. messageID = *GUID (e.g. edf395c9-4504-4fd0-87a5-d2c1523fe010)

4. APISignature = confirm

5. data = JSON data format

The above parameters are required when sending HTTP POST data to our API in order to receive a successful response. The data parameter must be composed using our Available Form Data fields.

Sample `3D Secure Confirm` Request

<?php

function httpPost($url, $params) //Post method

{

$params = json_encode($params); //Convert array of params into json string

$ch = curl_init($url); //create a new cURL resource

//set appropriate options

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, $params);

curl_setopt($ch, CURLOPT_FOLLOWLOCATION, 1);

curl_setopt($ch, CURLOPT_HEADER, 0);

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_HTTPHEADER ,array(

"Content-Type: application/json"

));

$response = curl_exec($ch); //grab URL and pass it to the browser while assigning the response to `$response`

curl_close($ch); //close cURL resource, and free up system resources

return $response;

}

$APIURL = "http://acquirer-stage.myabpay.com/merchant/service"; //Set API URL to ABPAY staging environment

$params = array(

"APISignature"=>"confirm", //API Signature

"messageID"=>GUID(), //A new GUID is required for every new API Call

"username"=>"tester", //API Username

"password"=>"testsersystem", //API Password

"Data"=>array(

"transactionCode"=>"A2tcj25lfz5tUuFgdh",

"PARes"=>"96xjyybf3gm0vlbpm9znlekw1zcp3lzjy7nev07pwhvpvs6bdx",

"MD"=>"lbqnd9li29x38svutfuhvvaibk4mir"

) //Data fields required for request "confirm" API

);

$Response = httpPost($APIURL, $params); //User defined function used to POST data to API and assign the response to `$Response` variable

echo $response;

// More code...

?>

Data Required

Below is a table containing all the available fields for passing POST data into the data parameter within the `3D Secure Confirm` request.

| FieldsName | Description | Required | Field Definition |

| transactionCode | Transaction Code. The Transaction Code used in the Sale request | Y | AN(40) |

| PARes | PARes generated by the external system that processed the authentication with the Consumer | Y | AN(10240) |

| MD | MD generated by the external system that processed the authentication with the Consumer | Y | AN(10240) |

Fields Validation

Below is a table containing all the available fields for the data parameter within the `Sale` request including its validation. These are used when constructing the merchants request data.

| FieldsName | Description | Validation |

| transactionCode | Transaction Code. | ^[-_0-9A-Za-z]{0,40}$ |

| PARes | PARes | N/A |

| MD | MD | N/A |

Sample `Sale` JSON Document

The below sample demonstrates what is expected when passing POST data into the data parameter. When forming the data parameter, please refer to our guidelines above.

{

"transactionCode": "edf395c9-4504-4fd0-87a5-d2c1523fe010",

"PARes": "96xjyybf3gm0vlbpm9znlekw1zcp3lzjy7nev07pwhvpvs6bdx",

"MD": "lbqnd9li29x38svutfuhvvaibk4mir"

}

Data Returned

Below are the expected JSON documents returned from the request. Please have a read of our Expected JSON Documents on our sale API documentation, here you can find more information about all the expected success responses

{

"result": true,

"messageID": "edf395c9-4504-4fd0-87a5-d2c1523fe010",

"code": "0",

"data": {

"message": "Confirmation received"

}

}

Mastercard

Below lists all the available Mastercard Test Cards which can be used for testing when integrating to our services.

Please note that these Test Cards are subject to change.

| Card Type | Number | CVV/CVC | Expire Date | 3D Secure | Outcome |

| MasterCard Credit | 5100000000000510 | 123 | 12/2030 | Yes | Success |

| MasterCard Debit | 5124990000000721 | 123 | 12/2030 | No | Success |

| MasterCard Debit | 5100000000000701 | 123 | 12/2030 | Unknow | Success |

Visa

Below lists all the available Visa Test Cards which can be used for testing when integrating to our services.

Please note that these Test Cards are subject to change.

| Card Type | Number | CVV/CVC | Expire Date | 3D Secure | Outcome |

| MasterCard Credit | 4111110000000211 | 123 | 12/2030 | Yes | Success |

| MasterCard Debit | 4006260000002481 | 123 | 12/2030 | No | Success |

| MasterCard Debit | 4111110000000401 | 123 | 12/2030 | Unknow | Success |

Appendix Error Codes

The table below contains the possible error codes & descriptions a merchant can expect to receive when making requests to our API. The below is intended to help build a superior system by handling any exceptions that may occur when integrating. Please note that these error codes are subject to change.

| Error Code | Description | |||||

| 0 | Confirmation received | |||||

| 01 | 3D Confirm | |||||

| 100 | General Failure | |||||

| 101 | Invalid Username or Password | |||||

| 102 | Invalid APISignature | |||||

| 103 | Access API Denied | |||||

| 104 | Invalid Message ID | |||||

| 105 | Debit/Credit card transaction are not allowed | |||||

| 106 | Transaction Code already exists | |||||

| 107 | A Sale request with the sent transaction code is not present | |||||

| 108 | Authentication Error | |||||

| 109 | Not Enrolled | |||||

| 110 | Not Authenticated | |||||

| 112 | Transaction not executed | |||||

| 113 | Empth/Null data fields | |||||

| 114 | Message ID already exist | |||||

| 115 | Invalid date | |||||

| 116 | Incorrect date | |||||

| 117 | Currency cannot be process by Merchant | |||||

| 118 | Card Type cannot be process by Merchant | |||||

| 119 | Cannot Process ayn Transaction | |||||

| 120 | Invalid Fields | |||||

| 121 | Not found transaction | |||||

| 122 | 3D Verify failed | |||||

More...

3D Secure enables the consumers to enter a password to confirm their identity with the card issuer. If accepted, the consumer can then complete their order and once received by the merchant, the merchant has more confidence that the transaction is genuine and not fraud.

The 3D Secure protocol was developed by Visa to improve the security of Internet payments. The protocol is offered with the service name Verified by Visa. MasterCard has also adapted a similar protocol called MasterCard SecureCode. Both are designed to allow authentication of cardholders by their Issuers at participating merchants.